“Sydney now joins global cities including London, New York and Hong Kong that also have public transport on Google Maps” boasted Gladys Berejiklian, New South Wales minister for transport, last week that Sydney’s complex and confusing public transport system will now appear Google’s mapping service.

The minister neglected to mention the other 400 cities that already offer this service including Perth, Adelaide and Canberra in Australia. What’s more concerning is the attitude of public servants and governments towards access to what should be freely available data.

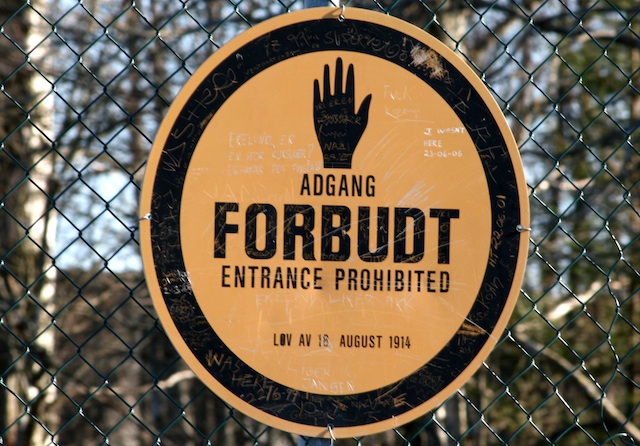

It’s difficult to think of anything less innocuous than public transport timetables yet access to the data is carefully guarded by most Australian governments under the claim of ‘Crown Copyright’.

Underlying the idea of Crown Copyright is all the information held by governments is the property of the state – or the monarch in Australia – rather than belonging to the people. This is a great example of governments and the law living in the 18th Century which gives a modern perspective of what the US founding fathers were thinking of when they wrote their constitution in 1787.

This refusal to make data available is not the attitude of any single government, the Victorian government notoriously refused access to fire information during the tragic 2009 bushfires and Google are still negotiating to add Melbourne’s public transport information to the Maps service.

‘Open Data’ is a concept that many agencies pay lip service to, as do many politicians while they aren’t in government, but in practice information is a precious resource which should be hoarded and hidden.

In the public service itself, information is power – your position and status with an agency is directly proportional to the knowledge you possess and the contacts you can hoard. This attitude spills over into the way services are delivered, or not as the case may be.

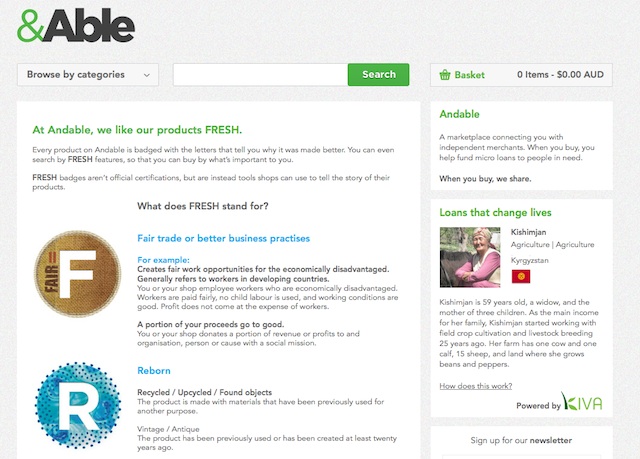

For startup businesses, this hoarding of data hurts local industry – with transport timetables application developers have to negotiate on a case by case basis for data access meaning that only big companies with plenty of resources are able to get hold of the information.

The tragedy is government are trying to encourage smaller developers and startups. New South Wales had its Mobile Concierge program but these well meaning initiatives fall down when agencies won’t open their data.

It’s time to scrap the idea of Crown Copyright and the philosophy that all government data is the property of the public service, or the monarch of the day. Certainly there are plenty of areas where it isn’t in the public interest to release confidential information but bus timetables are not one of those areas and there are plenty of laws already in place to protect that sensitive data.

Like many things in our political and legal sectors, thinking is stuck not in the 1980s but in the 1780s. Maybe it’s time to grab our politicians and their learned lawyer friends and drag them by their horse haired wigs into the 21st Century.