“I’ve been betrayed, I’ll never buy another Apple product again!” was the cry in 1998 when the company announced their new range of iMacs and portables wouldn’t support the long standing Apple Development Bus (ADB) system and floppy disks.

At the time Apple had been in decline, only the year before Microsoft had bailed the company out with a few conditions that had deeply irritated the company’s loyal customer base.

Many of those customers – mainly in education and graphic design – had invested deeply in ADB compatible equipment and their irritation at abandoning that investment for USB based kit was understandable.

Today we’re seeing similar protests about the rumoured dropping headphone jacks from the upcoming Apple 7 device, customers aren’t happy about the possibility being forced from a well established standard to a less reliable and likely more expensive system.

Unlike the computer world of 1998 today’s marketplace is very different, Apple is no longer a quirky and niche product but the most profitable of the tech industry’s giants – as Microsoft was back when Steve Jobs swallowed his pride and accepted Bill Gates’ bailout.

However most of Apple’s profits come from one product line, the iPhone. While the iPhone is probably the only truly consistently profitable smartphone, it competes in a fiercely fought for consumer market.

Already in China, one of the company’s most profitable markets, the iPhone’s market share is falling in the face of good quality but slightly cheaper Chinese and Korean devices.

Should Apple push those consumers too far by shifting the iPhone to a more expensive or proprietary system then the competing Android devices may well pick up market share and dent Apple’s fat profits.

However history shows that these hardware shifts do happen and older technologies are supplanted by more expensive, but better, inventions regardless of how much users have spent on the status quo. A century ago the automobile started replacing a millenia of investment in horse drawn technologies.

In the case of Apple abandoning the ADB back in 1998, it was the spur to adopt the USB standard which up until then had been buggy and unwanted as Bill Gates himself had found.

As history shows, Apple thrived after ditching the old technology despite the complaints at the time and if the company resists the temptation to lock users into a proprietary system there is no reason to think the same can’t happen again.

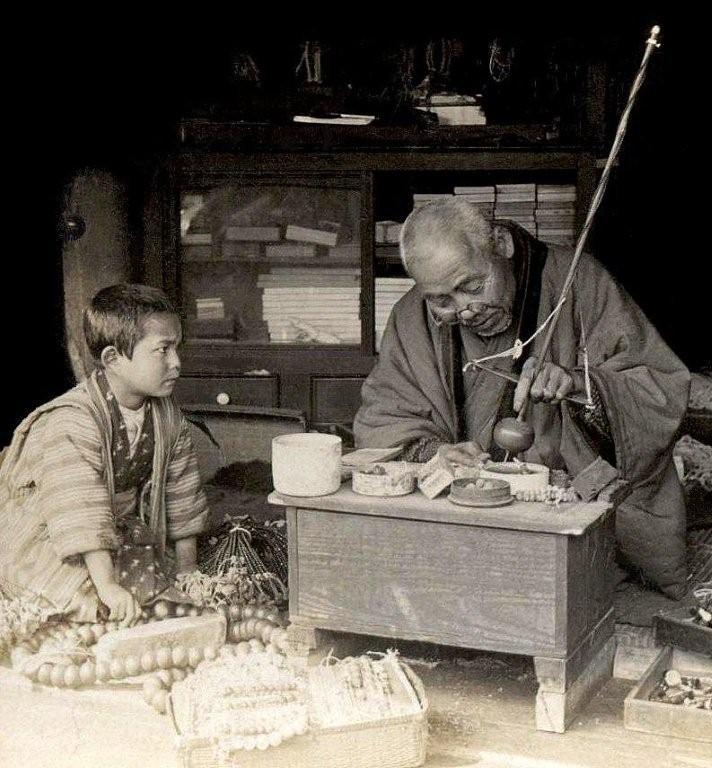

Apple mouse (with ADB connector) courtesy of Wikipedia

Similar posts: