As regular as the Olympic Games are, so too are the ticket scams. Every four years we see a ‘scandal’ of vendors, these days online, offering cheap or difficult to get tickets. This year’s London Olympics are no different.

The bait used by these scammers is the almost impossible to get tickets, the frenzy to get along to the opening ceremony or top days sucks dozens, sometimes hundreds, of enthusiastic punters into losing money.

It’s not just Olympic tickets, with the ease of setting up websites scammers can be online quickly with a credible, professional looking site and new services, like group buying and ‘penny auctions’ also offer great opportunities for the enthusiastic spammer.

While it’s sometimes difficult to spot the scams, there are some signs that can reduce the risk of your being caught out.

Check the site

How long has the domain been registered? You can quickly check the details by running a whois search, a kind of online registration check.

For .com sites, the authoritative Whois site is Network Solutions while for .co.uk sites (a likely candidate for London Olympic ticketing sites) it is Nominet. Each country has its own registration list and in Australia, for .com.au it is AuDA who run the My Web Name site.

A recently registered, or long standing, name doesn’t in itself indicate whether a site is a scam or not, but it is a good start.

What are the contact details?

A reputable site that wants your money should have a phone number and street address. A site that doesn’t have these is a warning sign.

Do a web search

The web is your friend. Use your favourite search engine to search the business’ name, for most people this is Google. This can show if there’s been complaints about the site.

Make sure you do a full name search, for instance if you are searching for Joe’s cutprice tickets put the name inside inverted commas such as “Joe’s cutprice tickets”.

Also do a search on the business address, if a company operates from the same location as dozens of others then it’s almost certainly operating from a service office.

While there’s nothing wrong with a business operating from a serviced office, if a company is claiming to be a large reputable multinational then it’s probably telling porkies.

Use a disposable password

If the site asks you to create an account or a password, use something different to your regular banking or other important passwords.

Some of these scammers are actually harvesting login details for online scams so don’t use the same password as your email or social media account as you may find your account hijacked.

Don’t use social media logins

Account hijacking is becoming prevalent on social media sites. The scammers get access to a victim’s Facebook or Twitter account and then contact all the victim’s friends posing as the victim. This is particularly effective for getting more people trapped in the scam.

Increasingly we’re seeing sites using social media logins, that is offering to use your Facebook account rather than a user name or password as a convenient way of signing up. These almost always give the site permission to post on your behalf and you should not do this unless you are totally confident in the site.

Pay by credit card

Even the best of us can get caught out by scammers, so paying by credit card means you have some protection from dodgy deals as you can dispute and reverse the transaction.

Note the words credit card, if you use a debit card many banks won’t give you the same consumer protections.

Avoid direct wire payments or online services like PayPal as you’ll probably do your cash or, at best, be bogged down in the dispute procedure.

Use common sense

The most important part of avoiding scams is common sense; if something is too good to be true then it almost certainly isn’t true.

An offer for hard to get Olympic tickets, fifty dollar iPads or a million dollars from a long lost cousin in Africa always come with a catch that leaves you out of pocket and possibly with your identity stolen.

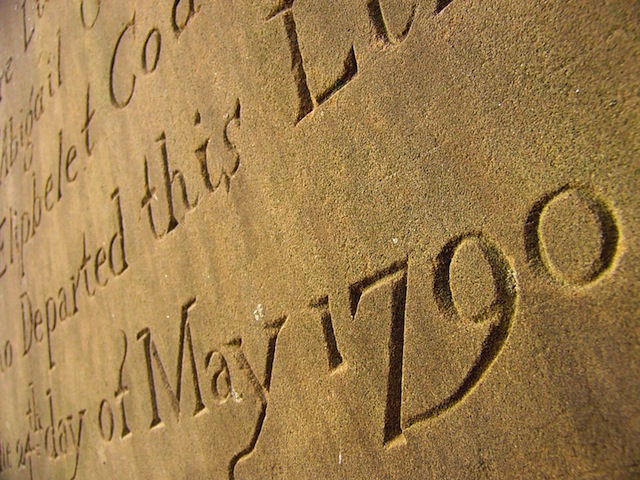

Many of these scams aren’t new, they’ve just evolved to take advantage the online world.

During the golden era of the snake oil merchant in the 19th Century, the phrase there’s a sucker born every minute was coined. Don’t be that sucker.