“On the Internet, nobody knows you’re a dog” says Peter Steiner’s famous cartoon. All of us who want to be taken seriously on the web have to prove we’re not dogs – or trolls, shills or just those who regurgitate cheap, nasty and unreliable content.

This is particularly true when you want to be a trusted news source; your audience has to be assured an article’s facts are true and the conclusions can be relied upon. That assurance is found in references to source material, the writer’s identity and the basic facts for the reader to decide how accurate the story is.

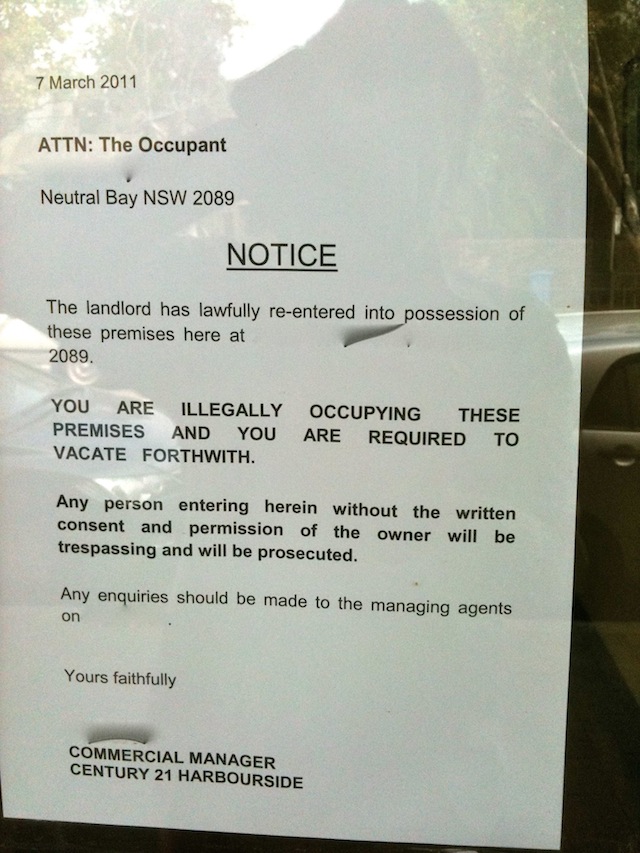

An article in the Sydney Morning Herald on Voice over IP security illustrates just how even mainstream, established media can get things wrong. This article tells us nothing; we don’t know who the writer is, it doesn’t link to source material and, unforgivably, the story leaves it to the reader to guess what the security problem was.

Because of Fairfax’s silly and inconsistent rules on external links I normally don’t link to Fairfax news articles. A good example of this silliness is illustrated in the above article where the reader has to copy and paste into a web browser the bit.ly reference to MyNetFone’s security advice which the writer has managed to sneak into the copy.

It would be nice to congratulate the writer on this little bit of subterfuge but the article doesn’t have a byline, the credit at the bottom simply says “Livewire” which probably refers to the long defunct IT section of The Age, the Sydney Morning Herald’s sister publication.

That the article also refers to Bleeding Edge, a long running Age technology column by Charles Wright which was discontinued some time in early 2006 and which Charles later tried to morph Bleeding Edge into an independent blog. It’s not good enough that we have to guess who the writer is.

Having a semi-anonymous writer, no byline and no links to supporting information might be all forgivable if the article actually told us what the problem had been with the phone account; did the evil Hong Based criminal mastermind hack the providers’ network, was it a security lapse on the writer’s network or had the user’s password been weak and compromised?

I suspect it’s the latter, but like most things about this article the reader is forced to guess. If the reader doesn’t have some level of computer expertise they’d be totally lost.

For organisations like Fairfax, the publishers of The Age and Sydney Morning Herald, the challenge in a society where the traditional newspaper model is rapidly dying is to build their online brand so they can bring advertisers across to it.

The only way they will succeed in this difficult task is to be trusted as a source of reliable information, and right now poor editing coupled with silly policies such as the one on linking out to other trusted sites are damaging readers’ trust in their brand.

Rather than sacking editors, publishers should be preserving them and making their online content more trustworthy than the bulk of the web with its dozens of content farms and millions of inconsistent blogs (like this one).

It’s only by having high standards that today’s media empires will survive the changes the Internet has bought, going cheap and losing the trust and respect of the audience is not an option.