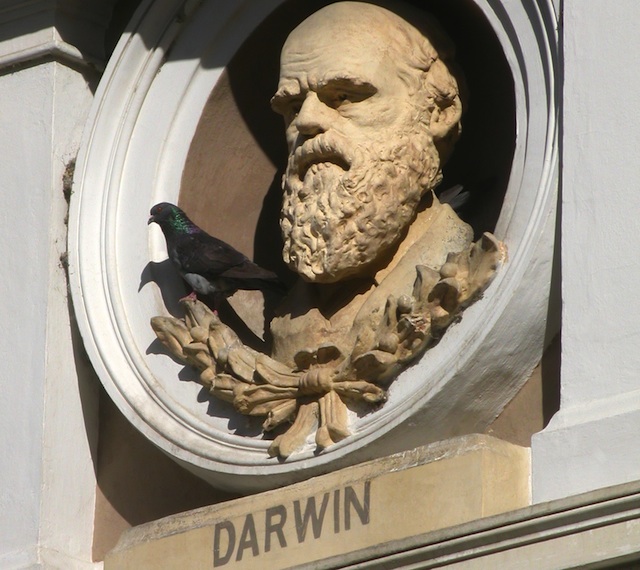

In the 16th Century English courtier Sir Francis Bacon declared “Knowledge is Power”, something certainly true during the conspiracy prone reign of Elizabeth I.

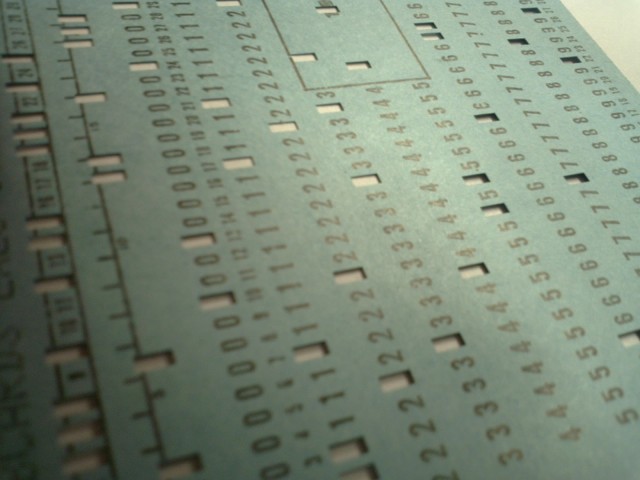

Today the data available about ourselves and our communities is exploding along with the computer power to process that information to turn it into knowledge.

We see that knowledge being used in interesting ways – US shopping chain Target recently described how they used data mining to determine, with 87% accuracy, to figure out if a shopper is pregnant.

That 87% is important, it says the algorithm isn’t perfect and bombarding a false positive with baby wear advertising could prove embarrassing, or in some families and societies even fatal.

A good example of data misuse are the two unfortunate Brummies (alright, one’s from Coventry) who were deported from the US for tweeting they were “going to destroy America and dig up Marilyn Monroe”

Despite the Pollyanna view of a world of transparency and openness driven by social media and online publishing tools, the information is asymmetric; governments and big business know more about individuals or those without power than the other way round.

In a world where politicians, business people and journalists trade on their insider knowledge rather than competing in the open, free market we have to understand that filtering this data is essential to retaining powers and privileges.

At present there’s lots of data threatening existing commercial duopolies, political parties and cosy ways of doing business.

The fact many of those in power don’t want to see what their own systems are telling them is where the real opportunities lie.

Entrepreneurs, community groups and activists have access to much of this data being ignored by incumbents, it will be interesting to see how it’s used.