This post originally appeared on the Xero Accounting blog under the title “Sorry, we’re not paying you”.

“Your star readings were negative after you serviced my computer,” the astrologer said sweetly, “so I’m afraid I will not be paying you.” Then she hung up. It was a good start to the week.

In business, bad payers are an unfortunate fact of life, one of the redeeming features is most of us end up with a great collection of reasons deadbeat customers give to justify not paying their bills.

Along with the downright strange is the quasi-legal; “your tax file number is in the wrong format, so we can’t pay your invoice” is one of the better excuses I heard in the years of running my business.

“I gave your technician a cup of coffee while she was here, so you’ll have to give me a credit” was another great claim.

A teacher once threatened to report my business to her union on the basis we were exploiting low paid women workers. The funny thing was we’d cut her a big discount because I realised she’d struggle to pay the full rate.

Big boys’ excuses

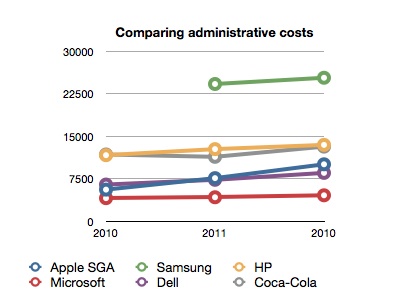

Those excuses were from smaller customers, but the corporate sector can be no better, some of them treat their suppliers as banks who give them an interest free loan

One multinational suffering cash flow problems decided to pay all bills after 270 days, regardless of the agreed payment terms. They didn’t bother with excuses and their accounts team were blunt – if suppliers didn’t like it, they could sue and wait five years for their money.

That company had its come-uppance when every supplier in the country put the company on a cash up-front basis to avoid a nine month wait.

Another big corporation decided to tangle their contractors in knots by implementing an arcane system involving submitting an invoice by the 30th of month one, backing it up with a statement of account by the 20th of month two paying thirty days later. Make a mistake or miss a date and the whole cycle started again.

Probably the most irritating excuses can come from government departments, a common one being, “our budget has run out for that item, so we can’t pay your invoice until the next financial year. Would you be able to reissue it under a new purchase order for paperclips?”

Chasing the bad news

A truism with collecting debts is the longer we let them slide, the less likely it is they will be paid so we have to be on the ball in chasing those late payers.

In Xero’s accounting software you nominate the due date when creating the invoice and this will appear on the copy the customer receives.

As soon as the due date has passed without payment, follow up with a reminder or a phone call.

Whenever you have a slow payer, it’s best to talk to them. Showing you watch our money closely indicates to the customer that you are serious about your bills.

Identify problem customers

The good thing about late payments is it’s a pretty reliable guide to who is a bad customer – if they constantly pay bills late, then you don’t need them in your business life and it’s time to get rid of them.

More insidious is the good client gone bad – a previously good payer who suddenly starts making excuses could be in financial trouble. If so, it’s worthwhile making sure your business isn’t too exposed if that client suddenly goes under.

At one client the secretary insisted on paying most of our bill out of petty cash. Two weeks later the company, a Scotch whisky broking service, closed shop and left thousands of angry customers and suppliers out of pocket. It took the creditors ten years to get a fraction of their money back and the secretary did us a great favour.

Not every late payer is a bad guy though, even in the best of times good customers can hit a bad patch so making arrangements with a good customer who has hit a rough patch can be a good long term strategy.

Incidentally, the astrology lady eventually did pay her bill. Attached was a note explaining something about planets transiting Scorpio during a waxing moon. We never heard from her again.

At least with bad payers we get to have a laugh at their excuses later, what the best stories you’ve heard from deadbeat customers?

Similar posts: