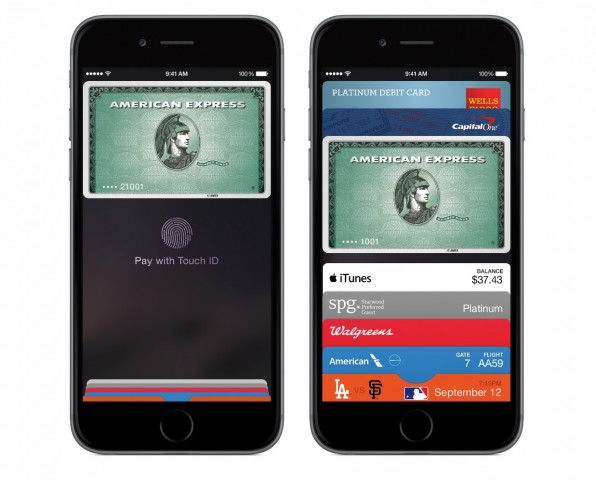

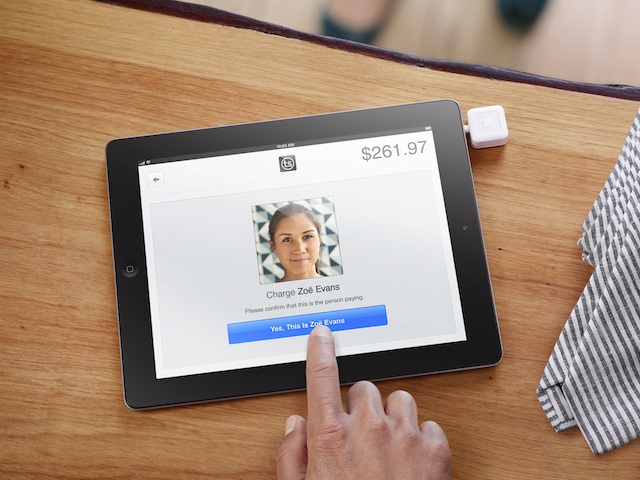

Has Apple Pay legitimised mobile payments? It appears so, reports the New York Times. Since the launch of Apple’s payments service, Google and other mobile payment providers are claiming usage has doubled with customers exploring the systems.

If this is true, it’s similar to how Apple legitimised the USB port in 1998 with the release of the iMac.

Prior to the iMac the USB port was a bit of an oddity, on most PCs the sockets sat unused and the few devices available on Windows computers worked reliably, as Bill Gates himself found out during a live demonstration at the 1998 Comdex show.

Unlike Apple Pay, the move to USB on Macs wasn’t welcome and it was a high stakes decision by Steve Jobs given that Apple’s existence was still precarious and its user base was still made up of largely of true believers who had been through years in the wilderness with the company.

Those users also had many thousands of dollars invested in Apple Device Bus (ADB) devices, all of which became redundant with the move to USB. Many customers at the time swore this was the last straw and they would move to Windows PCs.

Apple’s users didn’t carry out their threats and stayed with the company whose move to USB turned out to be a winner for the entire computer industry.

For Apple USB’s success meant their customers were no longer locked into a proprietary technology, for manufacturers they were able to start moving off archaic serial and parallel ports while for Microsoft the shift meant a better range of more reliable devices — although their operating systems struggled with USB until the release of the far more stable Windows XP.

It appears in this respect Apple Pay is repeating history in giving a boost to a technology that has been struggling to find traction in the market place.

The difference this time is that the payments industry is a far bigger market with far more implications for the broader economy than the computer peripherals segment.

If Apple raise the boat on payment systems, there are some incumbent businesses who are going to find themselves in a very different marketplace in five years time.