It’s becoming popular to describe Australia as a ‘Nanny State’ as governments respond to moral panics and the need to do something about anything from bicycle helmets to unpasteurized cheese.

Unquestionably Australia has changed in the last quarter century as governments of all persuasions have found it easier to legislate rather than lead. This has had effects on business and society in general.

A good example of how the regulations have built up over the last twenty years in Australia is a sign at my local beach.

That’s a fine welcome and it compliments the $7 an hour parking fees the local council levies. In itself, those parking fees are a good example of the price pressures driving Australia’s high cost quandary.

That’s a fine welcome and it compliments the $7 an hour parking fees the local council levies. In itself, those parking fees are a good example of the price pressures driving Australia’s high cost quandary.

Possibly the saddest regulation is the alcohol ban on ferries. Twenty years ago it was normal to see a group of friends unwinding on the way home from work with a cold beer or wine. Today you can’t do that because some bureaucrat decided drunks were a problem and rather than enforce existing laws it was easier to ban drinking entirely.

The press and moral panic

Much of this nannyism is being driven by the media who drum up hysterical reports demanding ministers do something. In turn the government’s panicky PR obsessed apparatchiks respond with pointless and unnecessary laws and rules. Often duplicating those that already exist.

A good example of cynical media hysteria was the story of Malea, a Sydney mum minding her own business while legally cycling with her child in a trailer.

While out riding a discredited journalist filmed Malea and passed the footage onto a current affairs TV show which portrayed her as a reckless mum and demanded such behaviour be banned.

Fortunately in that case the politicians ignored the confected outrage, but that’s the exception rather than the rule.

Doing something

The media though doesn’t have to force Australian politicians into adopting the nanny reflex. Often governments will create their own outrage in order for attention deprived politicians to get press coverage.

A good example of this was the incompetent Carr government which decided its contribution to the War On Terror after the 9/11 attacks would be to turn the Sydney Harbour Bridge into something similar to what welcomes Guantanamo Bay detainees.

It’s worthwhile comparing the same view on San Francisco’s Golden Gate Bridge and ask which is the greater terrorist target?

It’s worthwhile comparing the same view on San Francisco’s Golden Gate Bridge and ask which is the greater terrorist target?

When Sydney genuinely was a larrikin city, climbing the Harbour Bridge in the dead of night was a rite of passage. Today, if you can get around the security guards, barbed wire, CCTV and motion detectors you risk a $3,300 fine and being branded a terrorist.

When Sydney genuinely was a larrikin city, climbing the Harbour Bridge in the dead of night was a rite of passage. Today, if you can get around the security guards, barbed wire, CCTV and motion detectors you risk a $3,300 fine and being branded a terrorist.

If you try to climb the bridge and get caught, the fine is only half that of stepping on the hallowed turf of the Sydney Cricket Ground.

At the cricket, if you’re foolish enough to bounce a beach ball, start a Mexican Wave or sing out of tune and you’ll be out before you can say “Shane Warne is a safe driving ambassador.”

The Age newspaper gave a good example of Australian sports administrators’ Stalinist mindset in this fawning article which gloats over the efforts MCG staff go to in harassing their customers.

On level three of the Members’ wing is a secure room with the best seats in the house, although the occupants only manage an occasional glance at the game on hand. It is the MCG command post, where ground security, police and Securecorp officers constantly watch a bank of computer monitors and camera screens.

…

Dohnt says the camera operators will check the froth on a punter’s cup of Coke to see if it has been topped up with smuggled grog.

Hidden protectionism

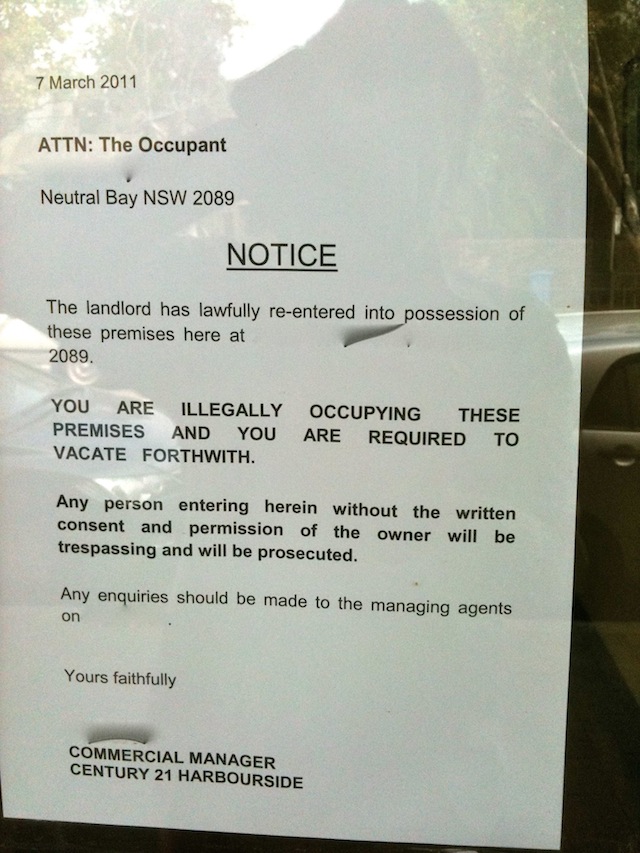

This sign, which is attached to the back of the one at the beginning of this story, bans vendors who sell from boats. It’s questionable whether the council actually has the power or resources to enforce this ban but if it helps the local shopkeepers then so be it.

This sign, which is attached to the back of the one at the beginning of this story, bans vendors who sell from boats. It’s questionable whether the council actually has the power or resources to enforce this ban but if it helps the local shopkeepers then so be it.

One of the hubristic traits of Australian exceptionalism is that the nation is a ‘free trade’ economy hard put upon by sneaky Japanese, American and European protectionism. The reality is Australia is just as good as Japan or the EU in introducing sneaky regulations to protect the well-connected locals.

A very good example of this is bananas where the Australian domestically produced product is substantially dearer than imported bananas sold in the US, UK or Europe.

In early 2011, Cyclone Yasi devastated Australia’s banana crop and prices soared. Not one imported banana was allowed in to ease the shortage. Remember that the next time you hear a politician or journalist boasting about Australia’s free trade credentials.

Banana prices are another example of the costs passed onto Australian households and industry through nanny state regulations. Compliance costs are real and add to the cost of production and employment. They are another reason why Australia has become a high cost economy.

More importantly, those regulations tend to favour incumbents making it harder for entrepreneurs and new entrants into markets making the economy even less flexible.

The burden of regulation is also unfairly dropped upon the smaller business who don’t have the resources to comply with or challenge unfair rules. The Howard government was very good at this with slapping small business with the responsibilities of raising the GST and complying with draconian laws like Workchoices.

At this stage it’s worth noting that the Australian nanny state isn’t a Labor party creation, it’s come from both sides of politics and often because poorly drafted laws require mountains of regulations to overcome the legislative flaws.

Workchoices was probably the best example of badly thought out laws where the Howard government panicked into slapping a whole level of punitive rules for businesses who failed to keep log books of staff hours worked – the legislation was so bad that had it not been repealed by Rudd, the sight of bundy clocks would have become common in Australian offices.

Nanny and risk

One of the unfortunate effects of the nanny state is that it saps the entrepreneurial spirit – why take risks when nanny is there to support you?

There is an unintended effect of this though – because we think nanny will always protect us we lose the ability to evaluate risk.

Where this is most obvious is in financial matters. Too often people are fooled into investing in dodgy schemes because they think that regulators will protect them. They find out this isn’t the case when the money is long gone.

That failure to understand risk though becomes pervasive through the community as the nanny state mentality becomes established. We could argue that inability to identify risk was the core reason for the global financial crisis.

The future nanny state

While the nanny state has been rampant around the world for the last fifty years, its days are numbered as cash strapped governments find they can no longer bear the cost of maintaining armies of bureaucrats to enforce silly rules.

As society deleverages from the excesses of the credit boom, governments are going to find revenues falling short and while it won’t be the first casualty of the new austerity, the nanny state will almost certainly be a victim.