Last week’s announcement that Woolworths will sell their Dick Smith chain of electronics stores wasn’t surprising and neither was the reaction of the chain’s founder to the idea of the business being sold to a foreign buyer.

For all his legitimate concerns about Woolworth’s growth model, Dick Smith is wrong about the sale of the stores. It’s almost essential for Australian consumers and business that the chain is sold to a foreign retailer.

When Dick sold his business to Woolworths in the early 1980s it was the beginning of a long consolidation process across Australian industry that now sees most business sectors dominated by duopolies or – at best – three or four incumbents.

In retail, the Coles and Woolworths duopoly dominates groceries, liquor and petrol. The power of these companies was illustrated yesterday with Coles’ announcement of price cuts to various greengrocery lines.

Having a new player enter the market is always an improvement; in neighbourhoods where foreign retailers like Costco and Aldi operate or where a keen, smaller operator decides to compete with the big boys the response is always better prices and service.

More importantly bringing in overseas owners will bring in fresh thinking and new ideas. New blood in the retail sector may even stem the brain drain where many young, innovative future business leaders are forced overseas because of the limited opportunities in the incumbent duopolies.

Where Dick is right is that the electronics retail business is dying as fat profits in the sector are a distant memory in what is now a tight margin, fast moving consumer goods industry. To make things worse, consumer electronics aren’t even fast moving in the post GFC economy.

Adding to the retailer’s pain the collapse in margins has happened at the same time commercial rents have risen dramatically with Sydney now being cited alongside Hong Kong, London and New York as the world’s costliest shopping strips.

While suburban shopping centres don’t have the same rents as the Pitt or Bourke Street Malls, they still have risen dramatically in the last decade, catching all retailers in a vice between rising costs and falling margins.

In order to maintain profits, training and staff development have been slashed. Once up a time, a customer would go to a Dick Smith or Harvey Norman store to get informed advice on the best gadget, those days are also long gone as poorly trained staff fight to sell the products with the best commissions.

Owners of the stores have made it harder to recruit and train motivated staff when employer consider hospitality and retail jobs to be temporary, low esteem positions with few prospects.

This deskilling isn’t just an issue for the retail industry – it’s something we’ve seen across the Australian economy in the last thirty years. As training and skills development has been seen as an unnecessary business cost.

Tourism Australia chairman Geoff Dixon’s recent comments about the Australian tourist industry having to accept being a high cost destination is a symptom of this disconnect. The local tourism industry has no chance of moving up the value chain when there is no service culture among staff and no long term management vision to develop one.

It would be unfair to just pick on any one individual or business for these problems. We have a structural problem in the Australian economy that’s fuelled by entrenched beliefs and habits of a stagnant senior managerial class.

We desperately need new people and ideas in Australian management to shake up the staid duopolies and oligopolies we’ve allowed to develop in the last three decades, that’s why Dick Smith is wrong to say a foreign owner for the electronics chain he founded would be bad for the country.

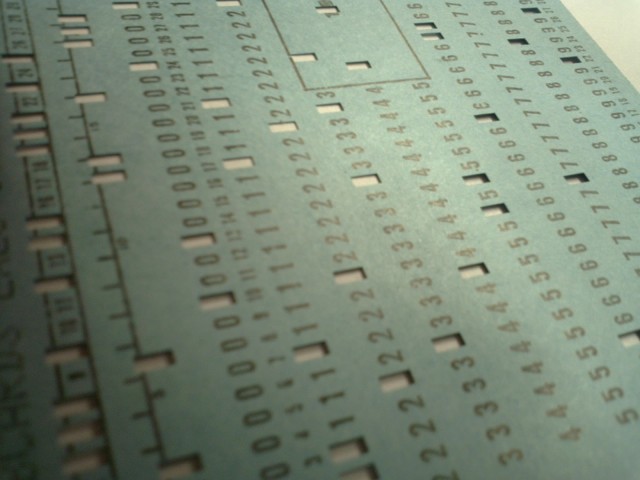

Image courtesy of Icelandit on SXC.hu

Similar posts: