Earlier this week the Financial Times reported how the eleven biggest North American and European banks had shed 100,000 jobs this year, so it when I was asked to do a segment on the future of banking for radio station ABC666 in Canberra I was more than delighted.

The ABC producer’s interest had been piqued by an Ovum research paper detailing the IT spending of banks and their increasing focus on security.

Rethinking payments

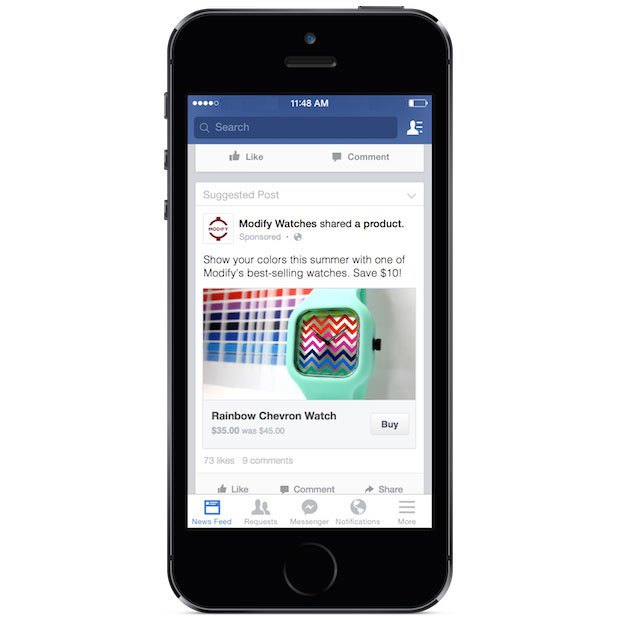

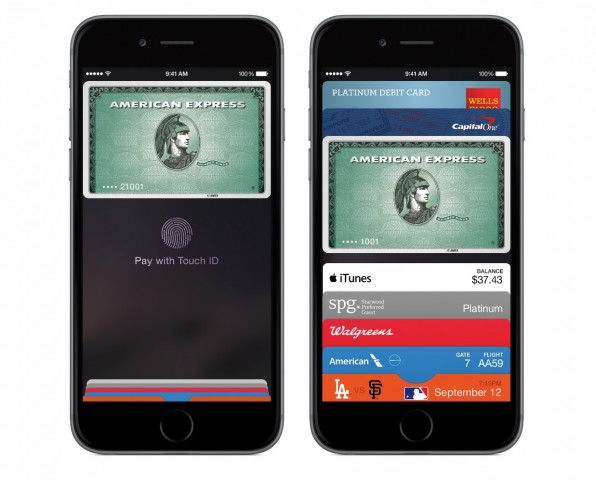

In Ovum’s view much of the banking industry’s security comes from the diverse range of payment options coming onto the marketplace. Another factor in the increased spend are the US credit cards moving to contactless payments.

Certainly the increased focus on payments security is being driven by the range of new devices with smartphones, wearable technologies and the Internet of Things opening up a whole new range of commercial channels. This is something driving the development of services like Apple’s and Google’s payment system and part of a wider battle over who controls those channels.

Underpinning much of the security focus is the interest in blockchain technologies which move the authentication records off central ledgers – historically one of the core functions of banking – onto a distributed network of databases.

Core challenges

That shift in record keeping is just one of changes affected the banking industry’s core functions, crowd funding and peer to peer lending threaten to displace banks from being the main providers of business capital, one of the fundamental reasons for the banking sectors existence.

It should be noted though the banks have largely stepped away from being the providers of small business capital over recent decades as the ill conceived ‘reforms’ of the 1980s and 90s saw the finance sector being more focused on housing lending and doing mega M&A deals with the big end of town.

The Financial Times report notes a decline in M&A deals is one of the drivers for the staff lay offs at the major banks, it’s notable that technology is changing that business function as much of the due diligence can be better done by artificial intelligence and algorithms rather than highly paid corporate lawyers and bankers.

Where have the bankers gone?

As the banks lay off senior staff, it’s notable many are finding their way to fintech companies. The Wall Street Journal however describes the relationship between incumbent banks and their would be disrupters as far more complex than it seems.

Increasingly banks are buying or taking stakes in promising startups along with establishing their own investment arms and running hackathons to identify potential disruptors. Many in the banking industry are quite aware of the changes happening.

That the banks are adopting the new technologies and identifying the threats shouldn’t be surprising, over the past fifty years the sector has been adept at applying technology from batch processing on mainframe computers through to deploying Automatic Teller Machines and rolling out credit cards to improve their business operations. Banking is one sector that’s proved itself fast to identify and adopt technological changes.

Are the banks going away?

So with fintech startups snapping at their heels, is it likely today’s banks are heading for extinction? Probably not suggests the CEO of fintech startup Currency Cloud, Mike Laven who describes such talk as being part of the “Level 39 bubble”, referring to the financial services startup hub based in London’s Canary Wharf.

Laven’s view is some banks will evolve while others won’t do so well and historically that’s what we’ve seen with other technological shifts – some of the incumbents adapt and reinvent themselves while others are not so adept and wither away.

Some of the bigger threats to banking may be social and economic change. Today’s rising of interest rates by the US Federal Reserve may mark the end of the last decade’s ‘free money’ mentality that’s been so profitable for them in recent times. The end of the consumerist era also challenges those financial institutions basing their business models on a never ending growth of consumer spending and household debt.

Almost certainly the banking industry is not going to vanish, however it is going to be a very different – most definitely a much leaner – beast in a few years time. What is certain though is the days of banks as we’ve known them in the second half of the Twentieth Century are undergoing dramatic change in the face of technological and social change.

Similar posts: