When discussing how industries are changing, the constant question is ‘what will happen to today’s jobs?’

Even in the Future Proofing Your Business webinar earlier this week this question was asked by a number of the small business owning listeners.

That concern forms the basis of the “A smart move: Future-proofing Australia’s workforce by growing skills in science, technology, engineering and maths” report released by accounting firm PwC yesterday in Sydney.

PwC’s report warns 44 per cent of current Australian jobs are at high risk of being affected by computerisation and technology over the next 20 years.

The report highlights that Science, Technology, Engineering and Maths (STEM) subjects are critical in the jobs that are going to benefit, or be created, by that technological change.

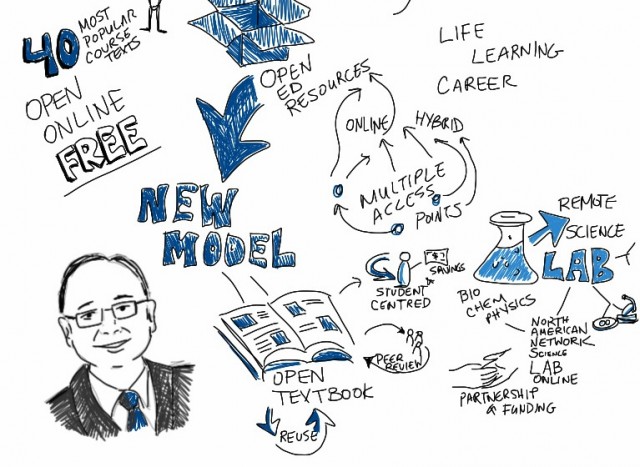

Finding the right courses

Sadly for Australia, and most of the western world, STEM courses are deeply out of fashion with students preferring to study in business related courses such as accounting, commerce and law.

As PwC flag, those industries are at risk with accounting at the top of the list for job losses.

On the other hand, PwC forecasts professions in health, education, personal care and – worryingly – public relations will be in increased demand. Something that may underestimate the effects of technology on those industries.

Competing with STEM

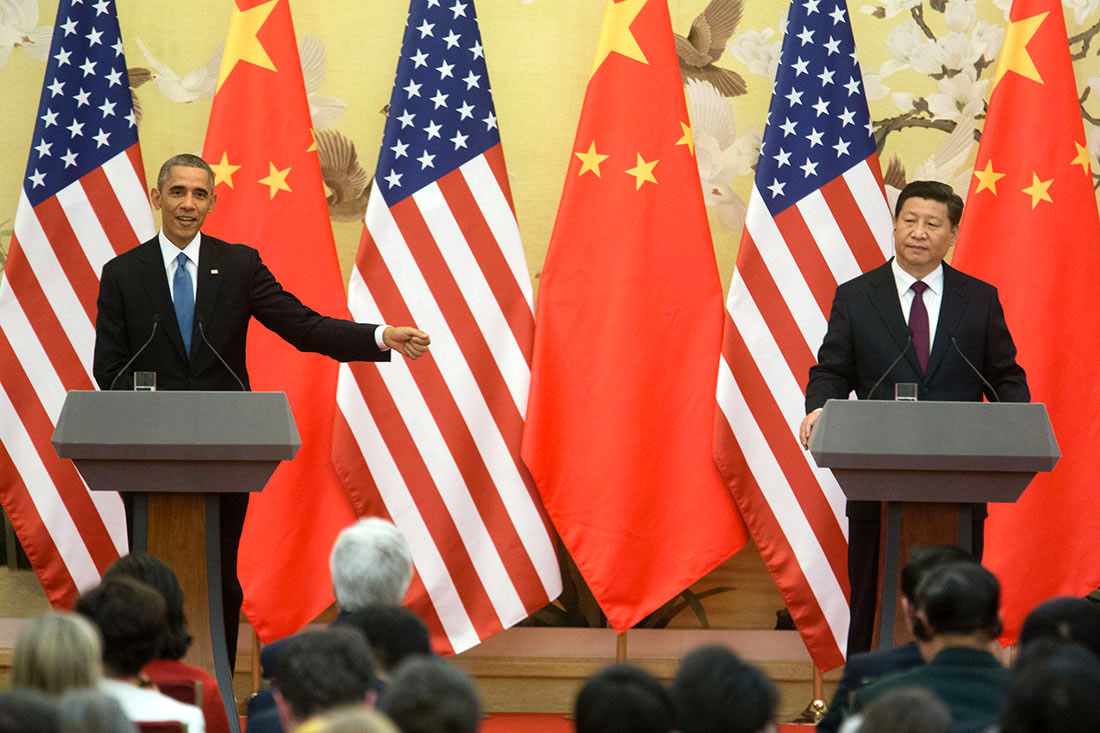

PwC’s main contention is that economies which want to compete in the new economy are going to need more STEM graduates.

The shift to STEM education is something the OECD highlighted in its recent report, OECD report How is the Global Talent Pool Changing?

In their report the organisation forecast that the number of students studying around the world would increase from 130 million today to 300 million by 2030 with all of that growth being in Chinese and Indian STEM courses.

Already that science and engineering emphasis is clear in today’s numbers.

To counter the drift away from STEM courses among students, PwC suggests a campaign to engage young people while they are still at junior school.

The Australian conundrum

Sadly, that’s unlikely to work in Australia given the nation’s economy is built upon property speculation driven by the wealth effect of rising real estate prices.

Two nights before the PwC report one of the highest rating shows on Australian television came to its 2015 finale. The Block, which features couples renovating and flipping properties, finished its season the apartments being sold at auction at record prices and the contestants pocketing between 600 and 800,000 dollars for a few month’s work.

For young Australians the message from their parents and society is clear; don’t innovate, don’t create, just buy as much property as you can afford.

In the US on the other hand, the business heroes are the builders of new enterprises; people like Steve Jobs, Elon Musk, Bill Gates, Mark Zuckerberg and the founders of Google.

Other countries like Israel, India and China, are aspiring to be the next generation of tech leaders. That’s what’s necessary to build a dynamic economy.

Creating enduring jobs

As the PwC report claims, “the jobs most likely to endure over the next couple of decades are ones that require high levels of social intelligence, technical ability and creative intelligence”

Harnessing that combination of social, creative and technical intelligence is going to be one of the challenges for all economies in a decade of change.

Getting the supply of STEM skills right will be essential for success for all countries at a time when digital technologies will drive most industries.

Similar posts: