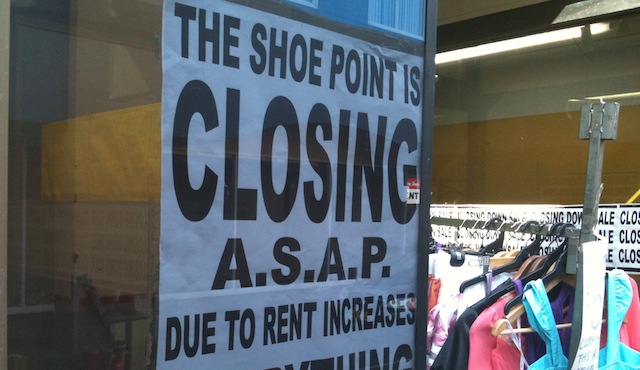

At the local shopping strip, it appears the rent has become to much for the local storekeepers.

Maybe the local businesses need this guy?

At the local shopping strip, it appears the rent has become to much for the local storekeepers.

Maybe the local businesses need this guy?

Google Places is a service that every business should sign up to, however Google’s policies at the moment mean you have to take care with how you use the listing.

At present Google are enforcing their listing rules in unpredictable ways and we’re hearing businesses are having their accounts suspended for what appears to a misreading on Google’s part of their own policies.

More importantly, there are stories of businesses who have updated their details and found their listing goes into “pending” status and their page is pulled from local search results until their revisions are reviewed by a Google staffer.

Often when the review is done, the listing is denied as being in breach of the rules which effectively bans the business from Google Places until the error is fixed.

Fixing the problem is difficult as the Google rejection emails are cryptic and, unfortunately in this era of the social business, come from a “no-reply” account with no sign off name, so there’s no way to find out exactly where the problem lies.

Given the uncertainty around Google’s policies in this space, it’s best not to make any changes to your Google Places account unless it’s absolutely necessary to update essential information.

If you haven’t already listed your business on Google Places, we’d still urge you to do so. Just make sure you get all of your details correct and pictures uploaded before you submit the entry.

As Groupon struggles to get its public offering to the market and the startup mania continues in the tech sector, it’s worthwhile having a look at what underpins the modern Silicon Valley business model along with it’s limitations and risks for those who want to imitate it or invest in it.

Distilled to the basics, the aim of the venture capital funded startup is to earn a profitable exit for the founders and investors. While there’s some exceptions – Apple and Google being two of the most notable – most of these businesses are not intended to be profitable or even sustainable, they are intended to be dressed up and sold onto someone else.

This can be seen in what many of these companies spend investors’ money on; in an example where a startup receives 10 million dollars VC investment, we may see a million spent on developing the product, five million allocated customer acquisition and four million on PR. The numbers may vary, but the proportions indicate the investors’ and management priorities.

Focussing on PR and customer acquisition is essential to attract buyers, the public relations spend is to place stories in the business media and trade press about the hot new business and spending millions buying in customers backs the narrative of how great this business is. By creating enough hype about a fast growing enterprise, the plan is prospective buyers will come knocking.

But who buys many of these business? In some cases a company like Microsoft or Google may buy the startup just to get the talents of some smart developers or entrepreneurs, but in many cases it’s fools being parted from their money.

The greater fool model the core tech start up model; two guys set up a business with some basic funding from their immediate circle; the friends, family and other fools. A VC gets involved, makes an investment and markets the company as described above.

With enough hype, the business comes to the attention of a big corporation whose managers are hypnotised by the growth story and possibly feel threatened by the new industry or have a Fear Of Missing Out on the new hot, sector.

Eventually the big business buys the little guys for a large sum, meeting the aim of the founders and venture capital investors. The buyer then steadily runs down the acquired business as management finds they don’t understand it and find it a small, irritating distraction from their main business activity.

While there are hundreds of examples of this in the tech sector, the funny thing is the biggest examples are in the media industry with Time Warner’s purchase of AOL and News Corporation of MySpace.

As a bubble develops we start seeing the Initial Public Offering arrive and this is where the lesser fools step in.

The mums and dad, the retiree, German dentists, the investment funds and all the other players of the stock market are offered a slice of the hot new business.

Usually the results are interesting; the IPO is often underpriced which sees a massive profit for the initial shareholders and underwriters in the first few days then a steady decline in the stock price as the pie in the sky valuations and the realities of the underlying business’ profitability become apparent.

Steve Blank, a Silicon Valley investor and entrepreneur, put the greater or lesser fool scenario well in a recent article asking Are You The Fool At The Table? Sadly too many small and big investors, along with big corporations, are the fools at the table ignoring Warren Buffet’s advice on avoiding businesses you don’t understand and finding themselves the patsies that the Silicon Valley startup model relies upon.

The fundamental misunderstanding of the venture capital driven Silicon Valley model of building businesses is dangerous as our governments and investment mangers are seduced by the glamorous, big money deals. It’s also understandable funding from banks and other traditional sources is difficult to find.

An obsession with this method of growing businesses means that long term ventures with profitable underlying products and services are overlooked as investors flock to the latest shiny startup. That’s a shame and something our economy, and investment portfolios, can’t really afford in volatile times.

For business owners, the venture capital model might be a good option if your aim is a quick, profitable sale to a fool. If your driving reasons for running a business are something different, then maybe the Silicon Valley way of doing business isn’t for you.