“I always believe small companies usually illustrate big shifts faster than larger companies. In many ways big companies are responding to the shifts being driven by smaller businesses,” says Andrew Anagnost, the Senior Vice President of Industry Strategy and Marketing at Autodesk.

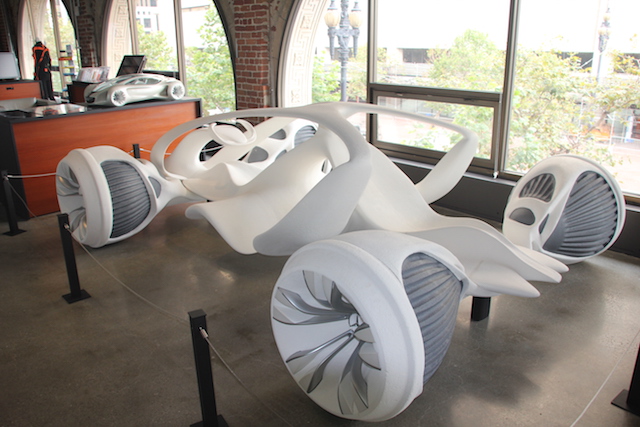

Anagnost was talking the Dreamforce media contingent after a tour of his company’s San Francisco Gallery where possibilities of today’s design and manufacturing tools are displayed.

Those possibilities are changing business, not just in design but across most industries as the means of financing and building new projects changes along with consumer demand as production methods change.

Anagnost breaks these changes into four major trends – the way things are designed, how they are produced, the nature of demand in a world where things can personalised and the very notion of what a product is.

“What people expect in from products today is very different.”

A supercomputer at your fingertips

“Every generation brings something new to design,” says Anagnost. “Imagine the generation that grew up with social media, online gaming, all the things that previous generations did not grow up with.”

This generation will be more collaborative and the idea of working in fluid, unstructured groups where many of the members will never physically meet anywhere.

Cloud computing is the other factor Anagnost sees as changing design as “it puts a supercomputer behind every screen”, which brings to the desktop great power in testing designs. “The designer gets a chance to explore options they couldn’t access before.”

That supercomputer at your fingertips changes all businesses, giving them processing power to carry out complex analytical tasks and modelling in all industries.

Financing the change

Another change to the production process is how people are financing their products. Increasingly platforms like Kickstarter are creating new ways for entrepreneurs to raise funds and also to test the market for a product before investing money and time.

“Before people would have to pitch their ideas to a larger manufacturer, an investor or a VC but now they can pitch it to anyone,” says Anagnost. “The means of financing products is now changing.”

The new means of production

‘Fabless manufacturing’ promises to change manufacturing by reducing the need for massive factories as micr0-factories start to change the economics of making products. These miniaturised robot factories are easily configurable and can be located locally rather than across the country of oceans.

Coupled with 3D printing, again it becomes cheaper and quicker to bring products to market and changes the dynamics of getting goods to market. “When it gets cheaper to deliver a complex product, the field gets levelled and more people can deliver innovative products to market,” says Anagnost.

The other trend within manufacturing is prefabricated assembly. While nothing new, improved design tools and manufacturing methods are making it easier and more efficient to assemble things like buildings onsite, coupled with 3D printing this is going to see massive changes in sectors like the construction industry.

Generational changes

Changing manufacturing and designs creates changed consumer expectations, as design becomes more accessible and personalisations easier customers are increasingly going to want products that meet their specific tastes and needs.

Another aspect to this is generational change, where younger consumers expect personalised products and don’t identify the same way with major brands as their grandparents and parents did.

“We’re going to see a move from rampant consumerism to a more selective consumerism,” says Anagnost.

This means markets are going to be far more volatile as the brand loyalty erodes in the face of a demanding customer. You’re only as good as the last conversation you had with your customer and if they aren’t happy they’ll go elsewhere.

Connected devices

The final factor Anagnost sees is the world of connected devices, increasingly consumers will demand products that have online functionality built in.

Increasingly we’re seeing this with motor cars and in the near future we’ll be seeing devices as diverse as motorcycle helmets and light bulbs being shipped with networked capabilities.

“Everything in your home is going to be connected in some way and people are going to have that expectation they will be,” says Anagnost. “Sensors are getting cheaper and cheaper and cheaper. There’s an assumption of connectivity.”

What Anagnost and Autodesk are flagging is business is changing, barriers we thought were unsurmountable are increasingly falling. For every industry, easily accessible computing and manufacturing power is changing the competitive landscape.

Paul travelled to San Francisco as guest of Salesforce.

Similar posts: