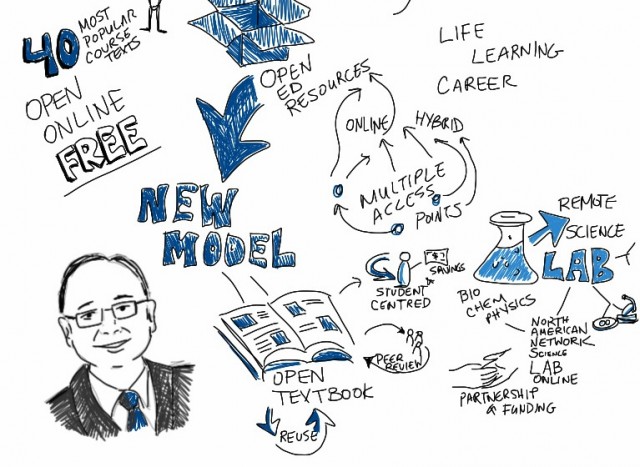

While the discussion of the workforce of the future focuses, quite rightly, on the role of workers how employers and businesses fit into a changed economy is important as well.

For businesses, the future of work affects not just the staff they employ but also the markets they cater for as those workers are also their customers. This is even truer for small businesses catering for local markets.

The Committee for Economic Development Australia (CEDA) report issued last week describes some of those shifts in the economy and they are as important to businesses as workers.

Where the money is

The key thing from the report is that some communities are going to be more seriously affected by automation than others. The map of Australia that accompanied the CEDA report showing the likelihood of jobs being lost in across the nation underscores that imbalance.

In those areas expecting large disclocation, business is about to get tougher as workers find their skills are no longer valuable in the face of automation.

Similarly, if local industries are becoming more automated then businesses servicing those industries are also going to need the skills to meet their customers’ more advanced needs.

Consumer facing risks

So small businesses in those districts of great disruption have to consider their markets; if they are consumer facing then their customer base could be shrinking while if they cater to other businesses then capital investment and finding skills in the new technologies are going to be required.

Even there, the picture is cloudy as upstream industries will be affected. A town that serves as an agricultural centre, for example, will see smarter farms using less labor.

In that town, those businesses servicing other businesses that serve local consumers will see their market getting thinner while those servicing the smarter farms and processors will need to buy new equipment and find workers with the skills to operate it.

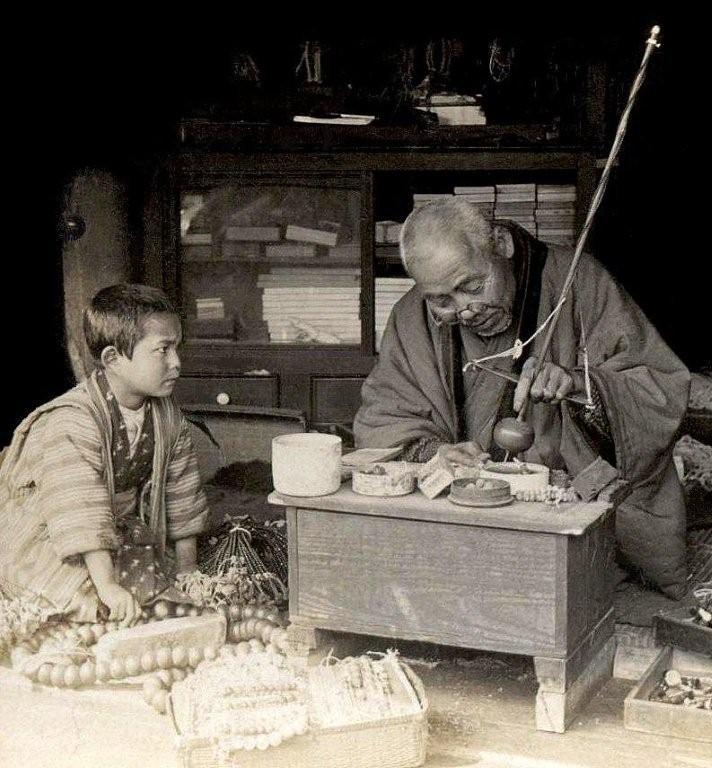

This isn’t a new phenomenon, it describes what’s happened to rural communities around the developed world as farming became industrialised through the Twentieth Century and the process is continuing as combines become self driving and automation replaces a lot of tasks currently done by labourers or manually operated machines.

Challenging the commuter belt

The question though is not just for rural enterprises, it applies for businesses everywhere as the workforce changes. It may well be the areas affected the most are commuter belt suburbs where white collar workers are displaced by artificial intelligence and algorithms creating problems for the local economy that’s based on services the needs of those middle class households.

It’s difficult to say for sure and that’s why the CEDA measures are based upon probability. For business owners and managers though, they’ll need to watch shifts in their marketplaces closely and watch for the opportunities that will undoubtedly arise from a changing economy.