Today’s links include a look at the complexities of the Charlie Hebdo discussion, how Lithuania intends a passive aggressive response to a Russian invasion and how Winston Churchill was not always Britain’s most admired figure.

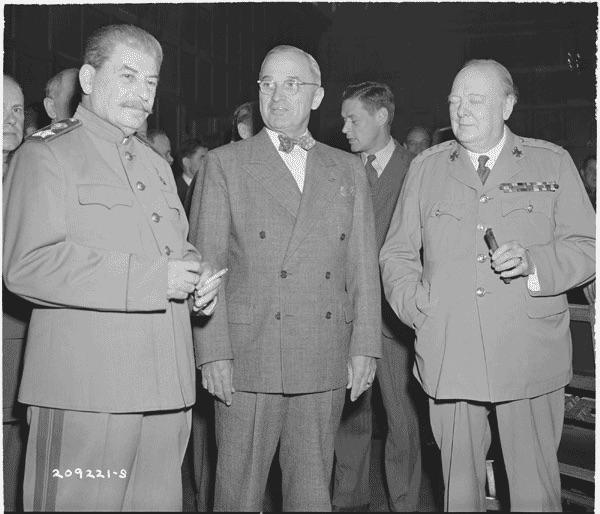

Should we hang Mr Churchill?

The New Statesman has delved into its archives to find its articles on Winston Churchill, it’s an interesting article that shows the complexities of the Churchill myth and legend.

Lithuania’s plan of passive resistance

Having the Russians occupy your country is a living memory in Lithuania. With the troubles in the Ukraine, the Lithuanian authorities are planning for a future invasion. Their advice is to be passive aggressive.

The world’s highest cost living

Which countries are the most expensive for a British expat to live in? Switzerland and Norway top Movehub’s list with the UK coming in tenth, New Zealand seventh and Australia sixth.

No, I am not Charlie

A British cartoonist’s view on the Charlie Hebdo murders illustrates the complexities beyond the facile soundbites.

The popping of the tech startup seed bubble

Has the tech startup mania peaked? The funds being invested into startups at seed stage seems to falling away, which may not be a bad thing suggest Alex Wilhelm.

What’s your password?

The Jimmy Kimmel show went onto the streets asking people what their passwords are. The results, sadly, are not surprising.