Around the world governments are trying to replicate the Silicon Valley startup model. But does that model really matter?

On the Citylab website, Richard Florida looks at which cities are the leading centres for startup investment.

Unsurprisingly eight of the top ten cities are in the United States with San Francisco and San Jose leading the pack. While London and Beijing make up the other two, the gap between the regions are striking with the Bay Area being home to over quarter of the world Venture Capital investment while the Chinese and London capitals com in at around two percent.

While these proportions are impressive, the numbers are not. The total VC investment identified by Florida in 2012 is $45 billion, according to the Boston Consulting Group there was $74 Trillion of funds under management in 2014.

That makes the tech venture capital sector .06% of the global funds management industry.

In the US alone over 2013 small businesses raised $518 billion in bank loans, more than ten times the global VC industry.

What this scale shows is how small the tech startup sector really is compared to the broader economy and, more importantly, how the Venture Capital model perfected in the suburbs of Silicon Valley is only one of many ways to fund new businesses.

Even in the current centre of the startup world, it’s estimated less than eight percent of San Francisco’s workforce are employed by the tech industry although that goes up to nearly a quarter in San Jose.

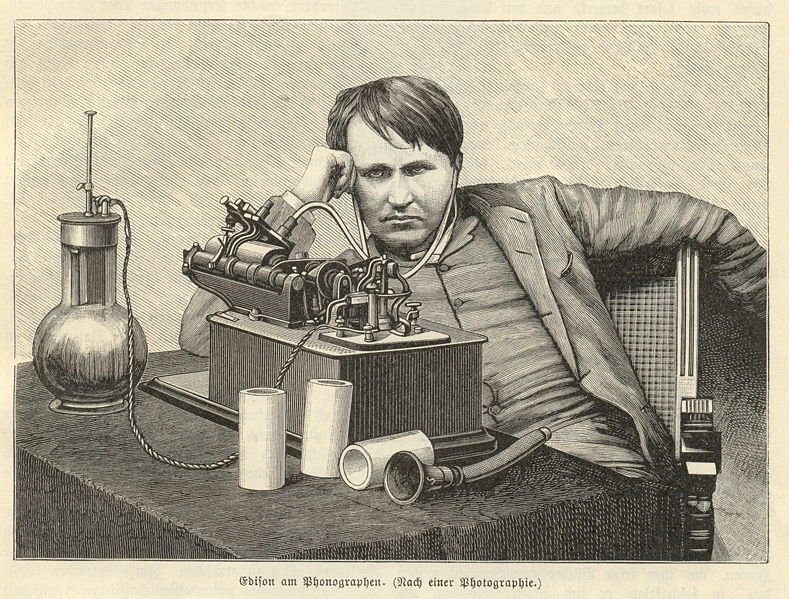

None of this is to say the startups are not a good investment – Thomas Edison’s first company raised $300,000 in 1878, $12 million in today’s dollars, from New York investors including JP Morgan. The Edison Electric Light Company, while relatively modest went on to being one of the best investments of the 19th Century.

That twelve million dollar investment looks like a bargain today and it’s highly likely we’ll see some of today’s startups having a similar impact on society to what Edison did 140 years ago.

Edison’s success created jobs and wealth for New Jersey and New York which helped make the region one of the richest parts of the planet during the Twentieth Century and that opportunity today is what focuses governments when looking at encouraging today’s startups.

So it’s understandable governments would want to encourage today’s Thomas Edisons (and Nikola Teslas) to set up in their cities. The trick is to find the funding models that work for tomorrow’s businesses, not what works for one select group today.

While the Silicon Valley venture capital model receives the publicity today, it isn’t the model for funding most businesses. Founders, investors and governments have plenty of other options to explore.