Excel spreadsheets lie at the core of business computing, but what happens when they go wrong?

James Kwak writing in the Baseline Scenario blog describes how Excel spreadsheets have an important role in the banking industry and their key role in one of the industry’s most embarrassing recent scandals.

In the early days of the personal computer spreadsheets; it was company accountants and bookkeeping clerks who bought the early PCs into offices to help them do their jobs in the late 1980s .

From the accounts department, desktop computers spread through the businesses world and the PC industry took off.

Over time, Microsoft Excel displaced competitors like Excel 1-2-3 and the earliest spreadsheet of all, VisiCalc, and became the industry standard.

With the widespread adoption of Excel and millions of people creating spreadsheets to help do their jobs came a new set of unique business risks.

The weakness with Excel isn’t with the program itself, it’s that the formulas in many spreadsheets aren’t properly tested and often incorrect data is put into the wrong fields.

In his story Kwak cites the JP Morgan spreadsheets that miscalculated the firms Value-At-Risk (VAR) calculations for synthetic derivatives. The result was the London Whale debacle where traders were allowed to take positions – some would call them bets – exposing the bank to huge potential losses.

It turns out that faulty spreadsheets had a key role as traders cut and paste data between various spreadsheets and the formulas that made the calculations had basic errors.

That a bank would have such slapdash procedures is surprising but not shocking, almost every organisation has a similar setup and it gets worse as a project becomes more complex and bigger numbers become involved. The construction industry is particularly bad for this.

Often, a spreadsheet will show out a bunch of numbers which simply aren’t correct. Someone made a mistake entering some data or one of the formulas has an error.

The business risk lies in not picking up those errors, JP Morgan fell for this and probably every business has, thankfully to less disastrous results.

My own personal experience was with a major construction project in Thailand. One sheet of calculations had been missed and the entire budget for lights – not a trivial amount in a 35 storey five star hotel – hadn’t been included in the contractor’s price.

This confirmed in my mind that most competitive construction tenders are won by the contractor who made the most costly errors in calculating their price. Little has convinced me otherwise since.

In the computer industry there’s a saying that “garbage in equals garbage out” which is true. However if the computer program itself is flawed, then good data becomes garbage.

Excel’s real flaw is that it can make impressive looking garbage that appears credible if it isn’t checked and treated with suspicion. The responsibility lies with us to notice the smell when the computer spits out bad figures.

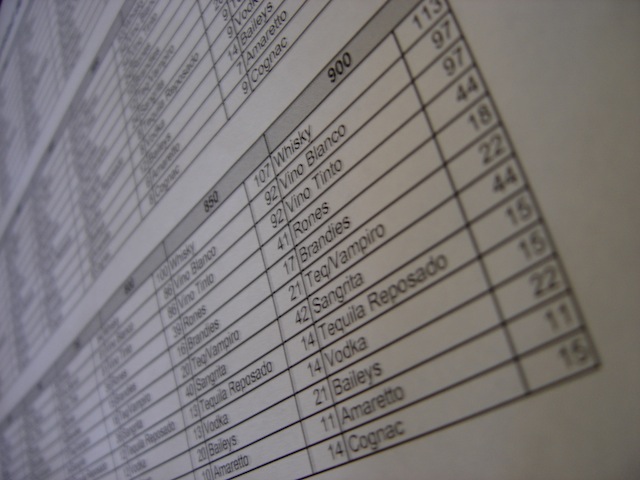

Spreadsheet image courtesy of mmagallan through sxc.hu

Leave a Reply