Last Friday cloud accounting service Saasu ran their Cloud Conference looking at the business benefits of online computing and business automation.

Among the topics discussed was the security of cloud computing with Stilgherrian giving an excellent overview of the state of information security.

Stil’s message is clear; online security is everyone’s problem – if the bad guys want to target you for whatever reason they will.

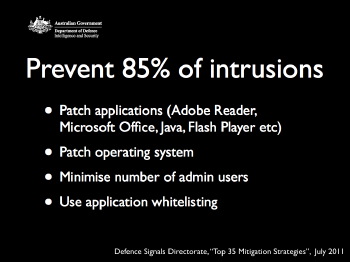

As a business owner, it’s essential to take basic precautions. This is something I’ve covered before and something Stil raises in his presentation by pointing out that Australia’s Defence Signals Directorate lists 35 mitigation strategies based on the security breaches they examined in 2010.

Of those thirty-five, the top five would prevent 85% of security breaches. The top one – keeping your applications up to date – would avoid almost every PC malware attack along with Apple Mac’s Flashback worm.

In answering my question about how Saasu and other cloud computing users can protect their system, Stil also raised a good point about using virtual machines for web browsing and even purchasing a computer just for business accounting and banking use so the services can’t be compromised.

Related to this topic is an ongoing discussion on the Reddit forums between posters claiming to be malware writers and botnet operators.

While it’s risky to trust everything you read on Reddit, the tips are worthwhile, particularly the advice to “disable addons in your browser and only activate the ones you need.”

By reducing the number of programs running on your computer or the add ons in your web browser, you lessen the risk of being infected. Again this would have protected the victims of the Flashback worm.

The security of our systems is our own responsibility, just like our home and office security.

Cloud computing is no different to other computing – the basics of information security, or #infosec, are the same regardless of whether you’re using software on your computer or the cloud.

Used responsibly, cloud computing is no less or more secure than any other computer or smartphone use. We shouldn’t underestimate the risks, or get hysterical about the threats.