One of the banes of running a business computer support organisation were cash registers.

Retail Point Of Sale (POS) systems were almost always arcane, clunky and difficult to maintain, at PC Rescue we dreaded a call from a shop, pub or hairdresser having problems with their registers.

Frequently this was by design, the POS system supplier would try to lock in their business customers into expensive support contracts.

By making it difficult for anybody without intimate knowledge of the product to actually do anything with it, the retailer was stuck having to hire overpriced custom support.

To make things worse, many of the POS systems ran on outdated hardware which offered the suppliers another opportunity to hit their customers (victims?) with high support costs.

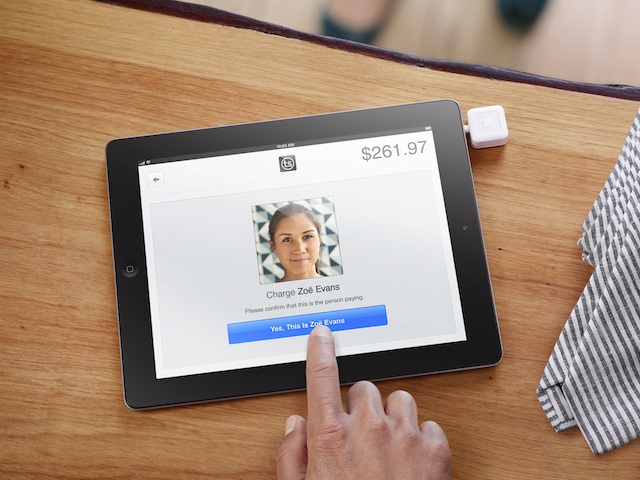

Since the iPad was released, I’ve been waiting for an application using cloud services for a back end that challenges the existing Point of Sale systems and today US online payments system Square has announced their Square Register app.

While only available in the US, Square has been setting the pace for physical payment systems like taxi fares and coffees using online technologies so it’s hardly surprising they are leading this push.

The iPad as a cash register is a logical step for the device and tied in with a robust Point Of Sales platform behind a simple to use app, it will probably make a huge dent in the point of sale market.

It may be the Square service won’t be the point of sale leader – Square is more a payments service than retail platform – which means this field is way open for some savvy operators.

One of the concerns with the Square service, and any iPad based application, is the spectre of vendor lock-in. Being fixed on the iOS platform means there is a risk of being held hostage to Apple’s business plans, also being locked into Square’s payment systems may not be the best choice for many merchants.

The payments and point of sale industry is another that’s being radically changed by mobile devices coupled with cloud computing. It’s not a time for incumbents to rest on their laurels.