“We’ve been completely blown away,” says Quberider founder Solange Cunin about the interest in the startup that looks to put science experiments into space.

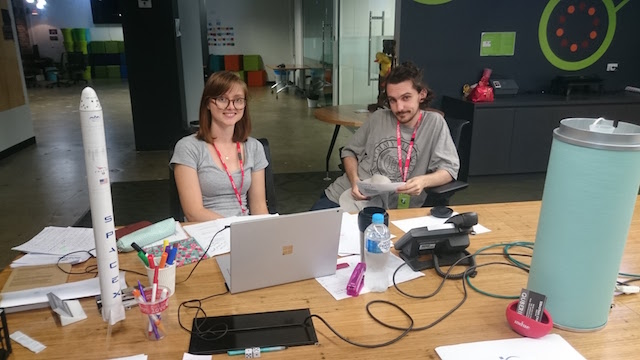

The company that was established by Cunin, a fifth year aeronautical engineering student, and her co-founder Sebastian Chaoui in early 2015 to provide school students with the opportunity to conduct experiments in space.

“Quebrider is a company that focuses on teaching core STEM skills that the current curriculum doesn’t focus on,” Cunin explained about the company. “Things like coding, data analysis and problem solving – all of those things industry needs. We do that in the context of students building their own space mission.”

The Quberider package starts starts at a cost of $5000 and includes a type of nanosatellite called a cubesat – a cube the size of a large coffee mug that contains ten sensors – along with teaching resources and a slot on one of the International space station launches. The program runs for three terms and integrates into the New South Wales high school science curriculum.

“Students end up creating their own software experiments and they sent it up on their own space mission,” explains Cunin. “They get that big bang and their own awesome feeling of being on something big and hopefully that gets them motivated to be involved in science a tech.”

In all, forty NSW high schools have prepared 60 projects ranging from one using the gathered information to create ‘space music’ through to an experiment measuring Einstein’s theory of relativity and time dilation to on the initial launch scheduled for the end of the month.

“Because it’s space it captures their imagination,” Cunin says of the program designed for years 9 and 10 students (14 and 15 year olds) but they have participants ranging from year 5 up to undergraduate level.

“We’re solving such an important pain point for many different people – getting students involved is a big problem for teachers and education and skills are a big problem for industry,” Cunin says.

The project developed out of Cunin and Chaoui’s joint passion for space projects and they came together when working as interns at another space startup.

While they are looking at a small amount of seed funding later this year, most of the startup’s capital has come from program fees and the support of the University of New South Wales where Cunin is a student and the University of Technology Sydney where Chaou studies. Quebrider is also part of Telstra’s Muru-D startup incubator program.

“We’re quite aware we have a lot to learn,” says Cunin about the Muru-D program. “Signing up to this with a good mentor program is important. The big value for us is the mentorship, we meet our advisory board once a fortnight and they’ve become part of the family.”

Ultimately Solange Cunin would like to see their program spread across the country. “What I’d really love to see is nationwide every single student that goes through year nine or ten has a space mission. They get to be part of something bigger and that inspires them and shows that science isn’t something nerdy and is cool.”

As the price of loading payloads onto satellites falls, it’s almost certain these experiments will become more accessible for schools and students.