One of the saddest things in life is the company that bleats ‘but we thought of it first’ when overtaken by a smarter or more credible competitor.

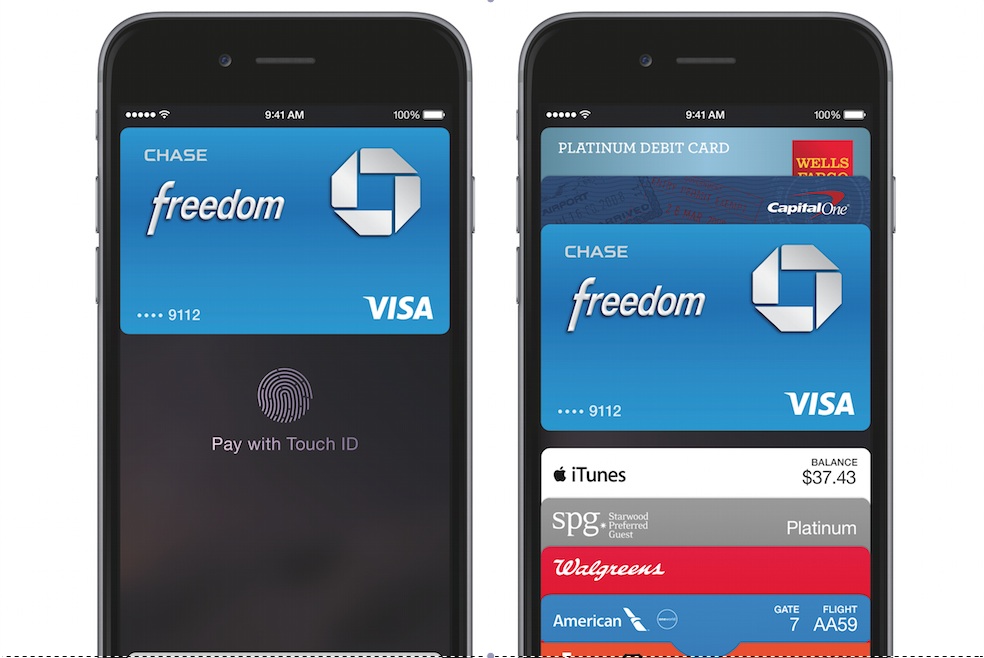

Since the release of the iPhone 6, the knives are out for Apple with Samsung, HTC and even Sony poking fun at the new product pointing out the features already in their products.

The problem for Apple’s competitors is the market isn’t listening to the attack ads. In China alone a million iPhones were sold in first hour they went on sale.

For companies competing with Apple they have to find a compelling product, not be sniping at the market leader. For Samsung in particular with its falling revenues it needs to be generating some excitement in the market, not depressing its customers.

Here’s the Samsung ad; while it’s pointing in the wrong direction it’s good in that it holds the critics to account but it makes not a spit of different to the marketplace.