Today sees another tough day for tech stocks with both Apple and Amazon missing their projected earnings which again finds Microsoft being stood up at their own party.

For Amazon, along with the costs involved with a new range of Kindles, there’s a huge write down in their Living Social investment, another indicator that the group buying bubble has passed into history alongside tulips, 19th Century Argentinian railway bonds and South Sea investments.

It’s worrying that while Amazon’s quarterly sales have increased by 23% over last year’s figures to $11.546 billion dollars, their cost of sales has also gone up 23% from $8.325 to $10.319 billion. This is a trend to watch closely over the next few quarters.

Unlike Amazon, Apple still made a fat profit with income going up to $8.2 billion for the quarter, an increase of 24%. This missed many Wall Street analysts’ estimates.

Apple’s missed earnings were put down to supply chain constraints and development costs, but what jumps out looking at the cash flow is the six billion turnaround in the company’s Accounts Receivable. One assumes this is the value of pending invoices on the new ranges of iPhones, iMacs and iPads sent out to their sales channel.

If that’s right, Apple are looking at a big boost in their cashflow next month, although there’s few companies who would like to have five billion dollars in outstanding invoices in today’s economic climate.

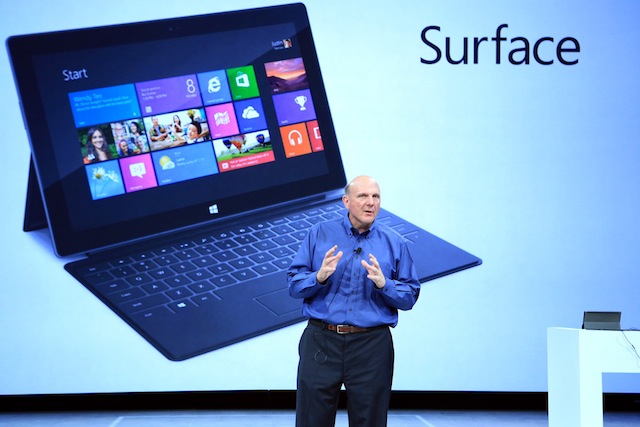

Once again though, Apple have managed to steal Microsoft’s thunder. Despite the glitz and glamour of the Windows 8 launch in New York, Microsoft’s announcement has been muted by the tech and business press’ reaction to the earnings reports.

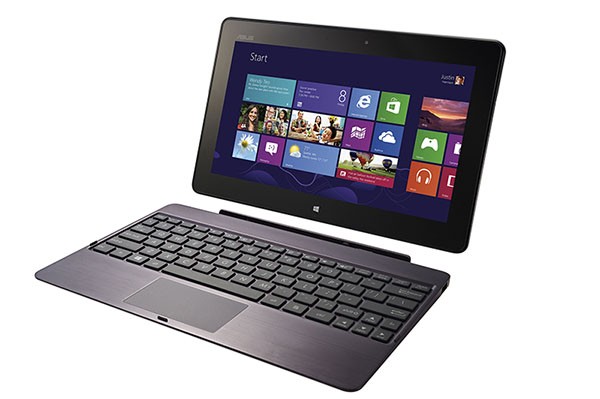

What is clear from all three companies though is that hand held devices – the Apple iPad, Amazon Kindle and Microsoft Surface – are going dominate the tech and financial coverage of all three companies for the rest of the year.