Oracle CEO Mark Hurd’s keynote at the company’s Open World conference in San Francisco yesterday illustrated a problem facing businesses around the world and its effects on enterprise software vendors like the one he heads.

“Standard and Poor’s top five hundred companies’ revenue growth is at one percent, their earnings growth is five percent.” “It means what? Expenses are going down.”

“This is the problem that the CEO has,” he says. “Why is it hard to grow revenue. All your investors want you to grow earnings and deliver growth. They have little patience for any long story about why it’s so hard.”

“They don’t care about any issues you may have. Grow earnings, grow cash flow, grow stock price. That’s it.”

Growing in a slow market

As a result of that the easiest way to grow earnings is to grow revenues but when global GDP and markets are flat, the only way to grow is to gain market share, Hurd says. “We have to know the customer better, we have to do a better job of marketing and we have to do a better job of aligning our goods and services to what our customers want. We have to improve our products and processes.”

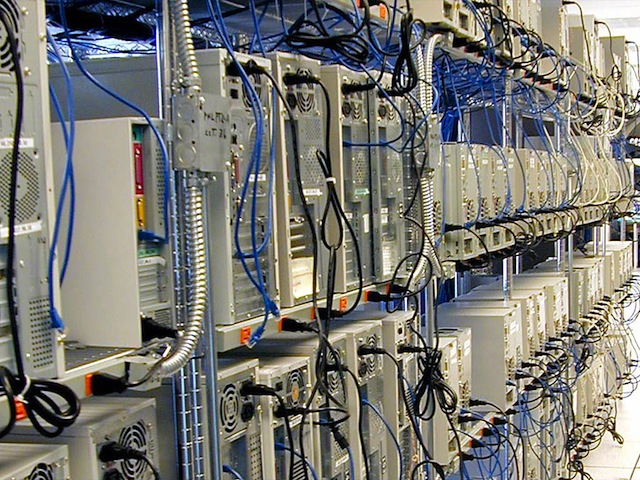

That imperative for companies to cut their operating costs has had a brutal effect on enterprise IT budgets, “over the past five years, the growth in enterprise IT has been flat.” Hurd says, “the growth in spending has been basically zero.”

Customers drive the market

Like many things in the tech industry, the sector’s growth focus has shifted to consumers, “consumer spending on IT has almost quadrupled in the past decade. So while companies are sort of flat, consumers have been spending like crazy.” Hurd observes, “consumers are more sophisticated, more capable, more knowledgeable and expect better services than ever before.”

“Your customer experience is not being defined by your competitors but by technology fuelled consumers. For instance, AirBnB may be defining customer experience for the hospitality industry.”

“People are using a lot of social technologies in their personal lives,” “we expect ease of use, simplicity, clean interfaces are now things we expect in the enterprise side.”

Crimping innovation

In the enterprise IT sector, Hurd believes the flat market means many companies catering to the corporate market are skimping on Research and Development which in turn is crimping innovation, a factor compounded by cloud providers taking an increasingly larger share of the market.

This is underscored by cloud leader Amazon Web Services spending over ten billion dollars a year on R&D. Hurd’s boast that Oracle is spending half of that shows how the legacy players are struggling.

What stands out in Hurd’s keynote is how legacy providers see cloud computing as their salvation. However Amazon’s dominance in that space is a major obstacle for them.

For consumers, big and small, the shift to the cloud has been a good thing in shaking up the existing industry and making new technologies more accessible to smaller customers. For existing businesses like Oracle, there’s a challenge in adapting to a lower margin, commoditized and quickly changing market.

A bigger question though facing all large corporations, not just software companies, is this new normal of low economic growth. Succeeding in that environment is going require a completely different management and investor mind set to that of the last seventy years.