I first became aware of the term “Channel Conflict” in the late 1990s when running an IT business that was a Microsoft reseller.

A channel conflict is where a supplier starts competing with the merchants they supply, or promoting one group of their customers against another. A good example is Google’s Travel Search that is upsetting many of Google’s own advertising customers.

As a local IT support business my channel conflict came from Microsoft advertising their own direct sales and consulting services as well as promoting their premium “gold” partners.

Conflict with such a big channel partner was frustrating and unavoidable given Microsoft’s position in the market. We couldn’t do anything about it except work towards Gold Partner status and differentiate ourselves from the competitors who had the advantages of Microsoft’s marketing.

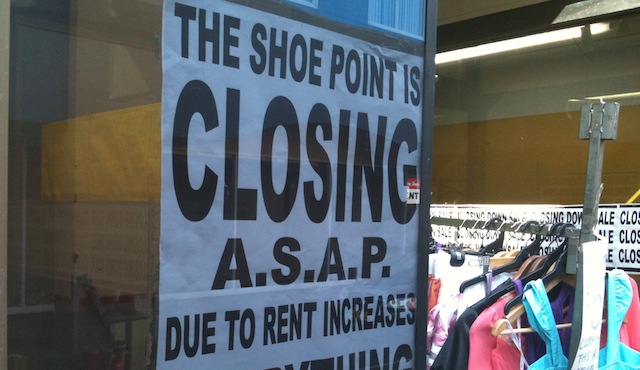

The web – in particular online commerce – is increasing these channel conflicts as the Internet sweeps away existing middlemen and allows others to develop.

A good example of how e-commerce is changing things was a tweet from Australian business broadcaster Brooke Corte where she found a swimsuits retailer’s prices were 40% cheaper through her shopping mall’s website.

Essentially the swimsuit retailer is being undercut by their own landlord’s e-commerce service – an incredibly difficult channel conflict.

For the retailer, they are up against Westfield; a big, multinational player with substantial market share and deep pockets who also happens to be their landlord in many high traffic locations.

It isn’t all bad news for the small retailer facing a channel conflict; Seth Godin has a good perspective of what happens when the big boys decide to play in your sandpit.

Seth’s situation was in 2008 Google launched a competitor – Knol – to his Squidoo businesses. This appeared to be the death knell, or Knol, for Squidoo.

Three years later, Google killed Knol.

In many cases channel conflict turns out not to be such a problem for the specialist retailer – big companies like Google, Microsoft and Westfield are good at what they do and dealing with the minutiae of retailing is not necessarily one of them.

Small businesses also have an advantage in the very online tools that are disrupting retail and other fields. TechCrunch recently looked at some of the mobile and price comparison tools and how local retailers can use them to compete with Amazon.

Coupling technology with service and focus – two factors that large companies usually struggle with – can define the battlefield for smaller businesses struggling with channel conflict.

As declining margins and new technologies tempt big suppliers into dabbling in areas they previously avoided channel conflict is only going to increase, though for the creative and confident businesses it isn’t the threat it first seems to be.