“It’s a kid in a candy store opportunity,” says Telstra CTO Vish Nandlall on being asked what excites him about the telecommunications industry.

Nandlall was talking to Decoding the New Economy about the challenges facing telcos in an industry facing massive change as the once immensely profitable voice and text services are being displaced by less lucrative data products.

Previously we’ve spoken to Nandlall about the future of Australia’s incumbent telco in a competitive market and this interview was an opportunity to explore some of the broader opportunities in a radically changing market.

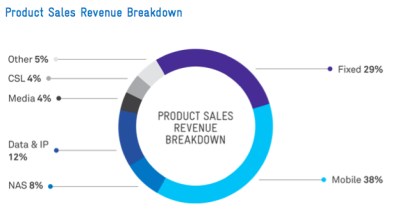

A data business

“While our business sounds complicated, we actually only do three things.” Nandlall observes about telecommunications companies, “we move data, we store data and we compete on data.”

“In the course of my lifetime in telecoms any two of those coming together meant a major shift. Today all three are converging.”

That convergence creates a range of challenges and opportunities, Nandlall believes. “When I look at what we see on the consumer side, I see the Internet of Things which really does promise a golden age of convenience.”

“Underpinning it all is going to be a massive transformation around data, the data insights suddenly become the thing that we’re going to need to differentiate our businesses from competitors in the industry.”

Differentiation through data

The differentiation of telecoms companies is going to lie in the software and data services being offered, Nandlall believes. “I don’t think telcos need to replicate Over The Top services,” he says in reference to services like Facebook or WhatsApp or Skype.

Nandlall sees the value for telcos in providing the next level of services in areas such as API management, content delivery and security. “We need to have new digital delivery systems,” he says, flagging software defined systems as being key to delivering to the new generation of telco services, “we can’t be restricted to fixed lines.”

Facing the skills shortage

The challenge facing telcos and all businesses is finding skilled workers, Nandlall observes. “Because change has been so rapid there has been a pipeline of students or workers being readily available.”

Nandlall sees initiatives like Cloud Foundry and Hadoop offering a means to address the skills shortage by standardising processes, reducing complexity and automating many of the tasks occupying today’s developers and technology workers.

This change also promises to speed up business as well and, combined with cloud services, changing the operating models of entire industries.

A new competitive advantage

For businesses without the scale of Telstra Nandlall has an important message, “I think we’ve hit a point in industry is where the competitive advantage is not just through some sustained differentiation,” he observes. “Today it’s about your ability to rapidly adopt new things.”

That rapid adoption is only going to accelerate, Nandlall believes, as the Internet of Things and wearable devices bring a whole new range of ways to collect and display information. For a kid fascinated with data, that’s a big candy store.