As the scale of technological change facing organisations becomes apparent, managements are appointing Chief Digital Officers to deal with the adjustment. Is this a good idea or just window dressing?

Last week the Australian Federal government became the latest administration to announce they will appoint an executive to manage the process.

Communications Minister Malcolm Turnbull said the Digital Transformation Office will be charged to co-ordinate the adoption of online services across agencies and state governments.

“The DTO will comprise a small team of developers, designers, researchers and content specialists working across government to develop and coordinate the delivery of digital services,” the Minister’s announcement stated. “The DTO will operate more like a start-up than a traditional government agency, focussing on end-user needs in developing digital services. ”

Minister Turnbull hopes to emulate the UK Office of the Chief Technology Officer which was launched with the intention of delivering streamlined sign ons, simplified government websites and easier access to online services in Britain; although the experience has not been a great success so far.

What’s notable about the UK experience is the CTO came with high level support within cabinet, which gave the agency a mandate within the public service to drive change.

A job without a budget

That the Australian CTO has no budget – its UK equivalent has over £58 million this year – indicates it will not have a similar mandate and will struggle to be little more than a letterhead.

When Digital Officer do have the support of senior executives and ministers, it’s possible to achieve substantial returns. Vivek Kundra, former Chief Information Officer in the Obama administration described to me in an interview two years ago how his office had created a dashboard to monitor government IT projects.

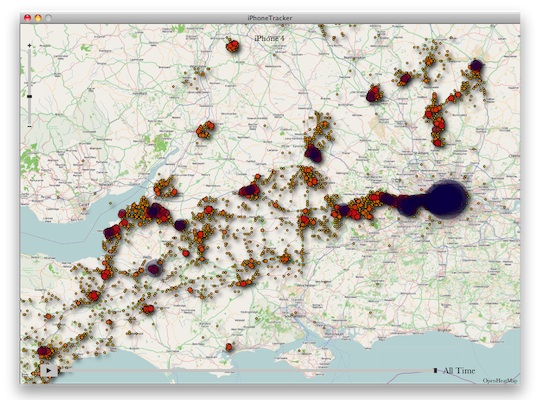

Kundra learned this lesson from his time as the US Government’s CIO where he built an IT Dashboard that gave projects a green, yellow or red light depending upon their status.

Some of these government projects were ten years late and way over budget, the dashboard gave the Obama administration the information required to identify and cut over $3 billion worth of poorly performing contracts in six months.

This is low hanging fruit that a well resourced group with the support of senior management can drive.

Looking beyond end users

A concern though with these CIO positions is they are only looking at part of the problem with the UK, US and Australian teams all focusing on end-users.

While no-one should discount the need for easy to use online services for customers or government users; digital transformation has far greater effects on private and public sector organisations with all aspects of business being dramatically changed.

In Germany a survey last year by management consultants PwC found eighty percent of manufacturers expected their supply chains would be fully digitised by the end of the decade, almost every industry can expect a similar degree of change.

The risk for CTOs focused on how well websites work is they may find the digital transformation within their organisations turns out to be the greater challenge.

Indeed it may well be the whole concept of Chief Transformation, or Digital, Officers is flawed as digital transformation is pervasive; it affects all aspect of business through HR and procurement to management itself.

Passing the buck

The great risk for organisations appointing a CTO or CDO is that other c-level executives may then believe those individuals are responsible for the effects of digital transformation on their divisions.

While Chief Digital, or Transformation, Officers can have an important role in keeping an organisation’s board or a government aware of the opportunities and challenges in a rapidly changing world, they can’t assume the responsibilities of adapting diverse businesses or government agencies to a digital economy.

Done well with proper resources and management buy in, a good CTO could genuinely transform a business and be a catalyst for change.

Regardless of the responsibilities a CTO or CDO assumes within an organisation, for the role to be effective the position needs the full support of senior management and adequate resources.

If a company or government wants to pay more than lip service to digital transformation then a poorly resourced figurehead is needed to drive change.

Similar posts: