One of the notable aspects of modern corporations is the inability of executives to identify failure.

A good example of this is the Australian department store industry. Like most Aussie industries it’s dominated by two major players, Myer and David Jones, both of whom have struggled with the realities of modern retailing.

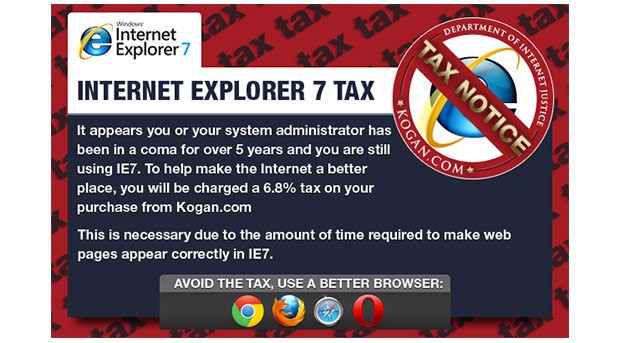

David Jones is notable for deciding the web was too much hard work in 2001 while Myer’s management whines about sales taxes despite struggling with antiquated point of sales systems and an inadequate online presence that still lags its international competitors.

This week illustrates both companies’ state of executive denial, yesterday Myer’s CEO Bernie Brookes blamed falling profits and escalating costs on the GST and labour rates – the idea that management should take some of the blame for increased overheads didn’t seem to occur to Bernie.

One telling comment of Brookes’ are his comments about productivity and global competitiveness.

“The sector would benefit from reform to help drive productivity and become more competitive in an increasingly global marketplace,” said Brookes.

Brookes’ comment illustrates just how the Australian corporate sector has flubbed the transition to operating in a high cost economy.

At the same time Bernie Brooks was bemoaning the state of the world, David Jones CEO Paul Zahra was opening a new small format store and – like all champions of free enterprise – blamed the government for slow sales.

David Jones’ new store is interesting in itself, notably this comment in the Sydney Morning Herald story;

Mr Zahra said the store had been especially catered to the wealthy demographics of the Malvern area with a focus on high margin items.

“Higher margin categories are what we have focused on and low margin categories are available in store but in the online system so we can get it shipped directly to people’s homes.

“And we get a better gross profit per square metre as a result.”

Welcome to the Twenty-First Century, Mr Zahra.

Both Zahra and Brookes’ statements show they learn nothing from failure, indeed they don’t even seem to acknowledge they have failed.

It’s understandable in modern corporate life not to acknowledge failure, in the alpha-male environment of the executive suite admitting failure is a form of professional suicide.

However not learning from mistakes is a recipe for making more errors – “those who fail to learn from history are condemned to repeat it.”

And that’s exactly what the hapless Myer and David Jones shareholders are condemned to, as are all the other businesses whose management doesn’t see its failures.