“Man, it’s a BlackBerry!” Exclaimed the assistant at the T-Mobile store on San Francisco’s Financial District, “I haven’t seen one of those in years.”

Generally that was the reaction in taking a BlackBerry around; a lot of bemused comments along with the the odd wistful reminiscence, usually from a forty something lawyer or banker, about how they used to love their BlackBerry back in the day.

So is the Passport is enough to rekindle Blackberry’s fortunes, or at least keep the company going until CEO John Chen can execute his Internet of Things strategy around QNX?

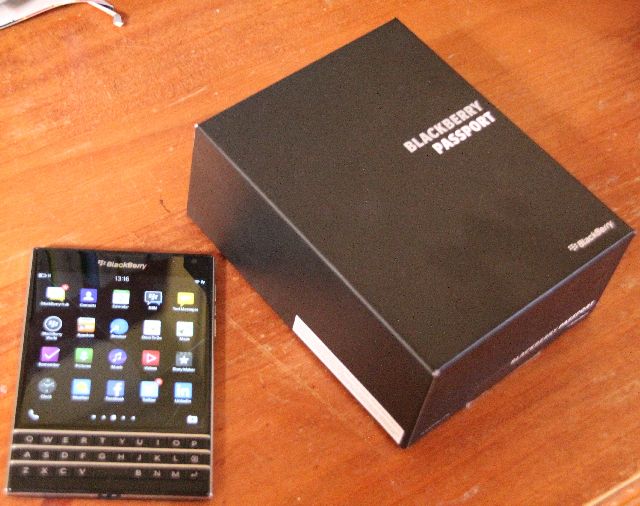

The BlackBerry Passport is an unusual device; with a square screen it’s a very different mobile phone that takes a little getting used to.

An irony for this reviewer is the tactile keyboard, with soft keyboards now the norm for smartphones, going back to a ‘real’ keyboard takes some getting used to and the Passport suffers from the real estate taken up by the keys.

A return to two thumb typing

The layout of the keyboard also takes some getting used to with the three row tactile QWERTY layout requiring two thumbs to use, compared to the one fingered swipe or typing options available on Android or Apple phones.

Only having three rows also presents a problem for inexperienced users — where are all the punctuation keys? The answer is they appear on the screen above while typing. While a bit clunky, the predictive software which determines which punctuation you’ll need works well.

Adding to the predictive typing features is a suggested word box that appears as you type, as one becomes more experienced in using the device this becomes a very efficient way to get messages out quickly. Overall BlackBerry has done a good job on designing the phone’s typing functions to get the most out of the form factor.

Another learning curve for users are the swipe functions, where an up gesture brings up the home screen and swipes to the the left and right let you navigate between screens and apps.

The main app on the phone is the BlackBerry Hub, a centralised repository for all information. The aim of the hub is bring together email, social media and text messages into one fixed location.

Bringing together information like this is always problematic as many of us are receiving dozens, if not hundreds, of emails, texts and social media messages a day. Overall though the Hub handles them well and integrates nicely with the major social media services including Twtitter, Facebook and LinkedIn.

The Appstore weakness

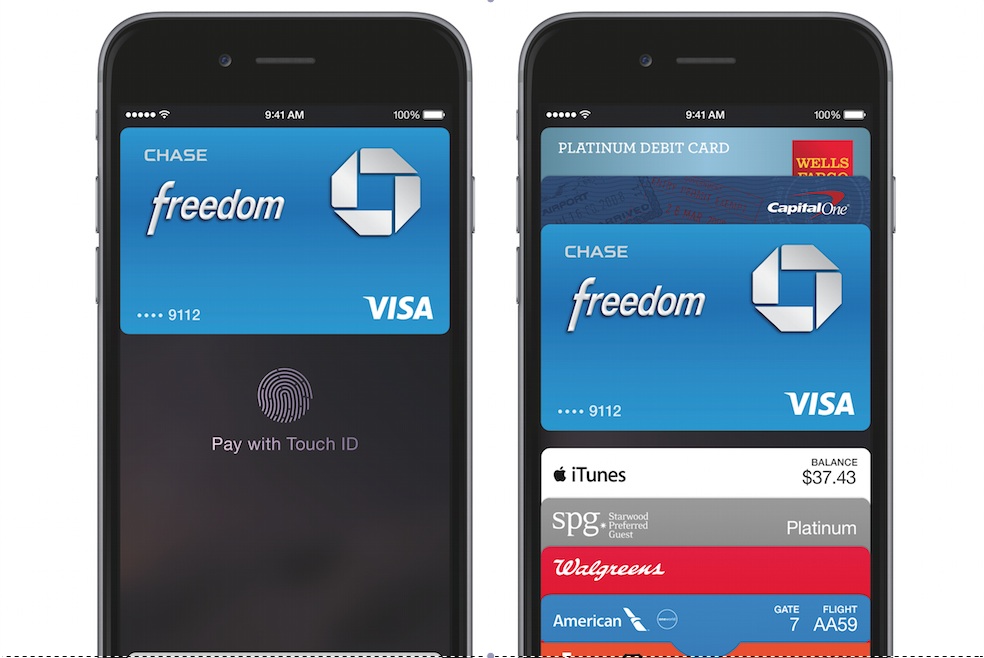

Where the software falls down is when venturing outside the pre-packaged apps — while things are better than they were, BlackBerry’s devices still suffer from a sparse app store.

The lack of a suitable WordPress app prevented this reviewer from testing out the device’s blogging potential which is a shame as the 1:1 aspect screen may well have proved to be better than the Apple and Samsung equivalents.

In the case of social media Instagram is a good example with the only free app, iGram, only offering Facebook and Twitter integration; a limitation that betrays the device’s excellent 13 Megapixel camera.

On the other important hardware matters, the phone’s battery gives well over a days life on heavy use, the company claims 24 hours talk time, and recharges through a standard Micro USB connector.

The decent battery life is reflected in the weight of the device with it tipping the scales at 196g, compared to the Samsung Galaxy 5’s 145g and the Apple iPhone 6 plus’ 172g. It’s not heavy by any means which shows some of the engineering BlackBerry has applied to the phone.

Inside the device is 32Mb of storage with the capacity to add up to 128Mb Micro SD memory, alongside the memory slot is the Nano SIM holder which worked well on both the US T-Mobile and Australian Optus 4G networks.

Maintaining the ecosystem

Unfortunately we were unable to review how well the device and its software integrated with the Black Enterprise Service as this is going to be the main selling point for the Passport.

Overall the BlackBerry Passport is a good corporate phone that’s going to appeal to organisations that wants to give their staff secure communications with smartphone capabilities.

However the handset itself is unlikely to appeal to the broader smartphone market. At best the BlackBerry Passport is an attempt to keep the company’s core market locked into the ecosystem while John Chen executes his pivot into new markets. It may not be enough.

In San Francisco’s Financial District, the guys at the T-Mobile shop are probably not going to see many more BlackBerry phones.