Microsoft’s annual Australian TechEd conference on the Gold Coast this week comes at an important time for the software giant as the company launches a range of products to meet the major threats to its tech industry dominance.

With the move away from desktop and laptop computers to smartphones, tablets and cloud computing services Microsoft’s profitable server and office franchises have become less relevant in a rapidly evolving market place.

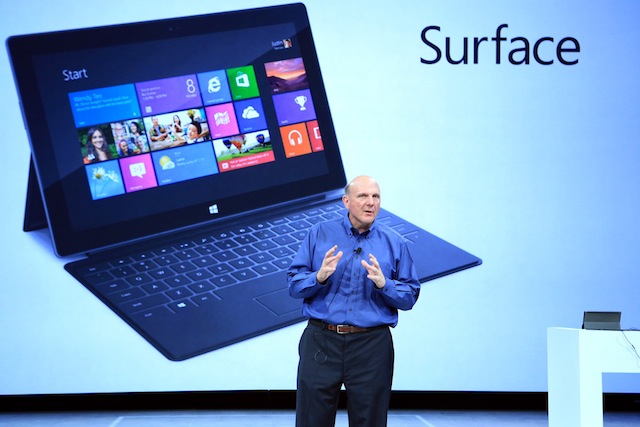

To counter this move Microsoft are refreshing most of their key product lines this year including launches of Windows 8, Windows Server 2012 and the high stakes Windows Phone 8.

Underlying these releases is Microsoft’s “one consistent platform” offering a seamless experience between traditional in-house servers, the company’s Azure cloud product along with the services of partners, integrators and resellers.

Core to Microsoft’s enterprise strategy is their Hyper-V virtualisation product that allows businesses to reduce costs and business complexity by easily replicating systems onto different servers or networks. At present Microsoft claims 25% of the Australian virtualisation market compared to VMWare’s 50%.

At the home and small business ends of the market Microsoft also have a “one consistent platform” strategy with services like Office365 offering the same look and feel regardless of whether they are using a smartphone, tablet or desktop computer.

Microsoft hopes to replicate the success they had in the 1990s by locking customers into their integrated cloud and server environment. This is consistent with the “own the customer” strategies of other major players like Apple, Amazon, Facebook and Google.

The flaw in trying to own the customer across all devices is the difference in technologies – what works on a desktop computer with a mouse, keyboard and large screen doesn’t necessarily succeed on a smartphone or tablet computer using a smaller touch screen.

Windows 8’s development has illustrated how Microsoft are struggling with their aim delivering a consistent look across all platforms as early users struggle with the now renamed “Metro” touch screen interface and demand they get their start buttons back.

The inconsistency between platforms also appears with the cloud based Office365 productivity suite which lacks many of the advanced features of the desktop Microsoft Office packages that dominate the PC market.

Office’s advanced functions are one of the areas where Microsoft has successfully held off competitors like Google Apps as office workers – and writers – find the richer features in the desktop application actually matter when using word processors or spreadsheets.

Another of the advantages Microsoft has over Google and other cloud based competitors is their army of software partners, integrators and resellers supporting their products.

One of the pillars of the “One Consistent Platform” strategy are the service providers who have built their businesses on supporting Microsoft’s products. With the move to the cloud many of these integrators and resellers have been threatened by the reduced margins offered by online services.

The stakes are high for Microsoft and their partners as the computer industry moves away from the model which has worked well for them over the last twenty years.

Whether customers will stay with the revamped Microsoft services and products is going to depend on how well the “One Consistent Platform” is executed. As Apple, Facebook and Google have shown, customers will stick with one service if their needs are being met.

Leave a Reply