Last Thursday saw China Mobile and Australia’s Telstra release their annual results.

Both have impressive numbers that illustrate how the telco industry is changing along with some stark differences between the two nation’s business culture.

For both companies their results show how voice and SMS are declining as the ‘rivers of gold’ for telecoms operators around the world; China Mobile’s voice revenues are down 6% while Telstra’s fixed line voice fell by a similar amount.

In Australia, the incumbent telco (which sometimes advertises on this blog) continued its dominant position in its market with net profit rising nearly 15% on the back of 6.1% increase in income.

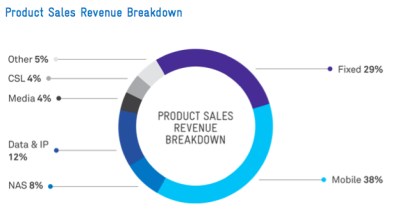

Telstra’s results also showed how the Aussie telecommunications market is now primarily a mobile sector; while the advantages of being the incumbent are substantial the real growth and profits in the business are in it’s non traditional sectors. It’s little wonder the company is happy to give away its legacy copper systems to the government’s troubled National Broadband Network.

In the PRC, the news wasn’t so good with China Mobile’s net profit for the first half of the year falling 8.5 per cent as its traditional voice and messaging businesses faced continued pressure from social media firms, despite revenue being up nearly five percent.

China Telecom is under pressure from competitors while in Australia the incumbents are doing very well. This is true across much of the Aussie economy.

While China Mobile is staking its future on its 4G rollout, Telstra is seeing the Internet of Things and Machine to Machine (M2M) markets as being the key markets, despite Gartner flagging the IoT as being at peak of the Hype Cycle.

It may well turn out to be the other way round — Chinese businesses and governments are far quicker to embrace the IoT than their Australian equivalents while Telstra’s biggest competitive advantage against SingTel Optus and Vodafone is it’s far superior 4G network.

China Mobile’s and Telstra’s competing fortunes tell us much about each country’s telecommunications markets along with the direction of both nation’s economies.

Leave a Reply