It didn’t take long for the competition in the payments market to heat up after the announcement of Apple Pay last week as PayPal launched a campaign asking if you’d trust your financials to a business who can’t protect your selfies.

While PayPal pokes fun at Apple, there are more serious competitive pressures developing as the companies start negotiating with credit card providers and banks to reduce their rates. This is something that will be an immediate benefit for businesses of all sizes who are prepared to renegotiate their contracts.

Most businesses, big and small, are poor at monitoring what they pay for a service; while they’ll shop around and negotiate when they’re looking for provider, they’ll let often these contracts go for years without reviewing them – something that utilities like banks, telcos and power companies take advantage of.

I was reminded of this earlier this week at a lunch with some senior Qantas accountants who were quite open about how every supplier’s contract was constantly reviewed and discounts were aggressively pursued. It’s a tough life for the airline’s subcontractors.

Times are tough for Qantas though, having sustained a 2.8 billion Aussie dollar loss last year along with constant declines in market share and stock prices. So it’s not surprising they have an aggressive cost cutting strategy in place.

Many other industries are now looking at the same problem as the global economy is now in a phase of at best anemic growth for the foreseeable future, which makes it essential for all businesses to start reviewing their costs.

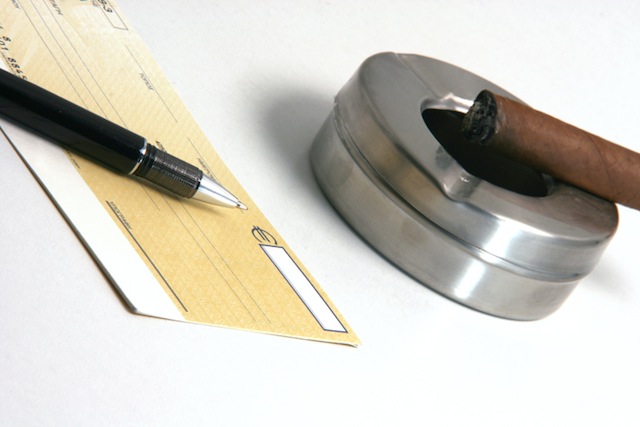

With the banking sector now being disrupted by companies like PayPal and Apple, it might be time for all businesses to ask some hard questions of their banks and payment providers. The time is right to strike a deal.

Leave a Reply