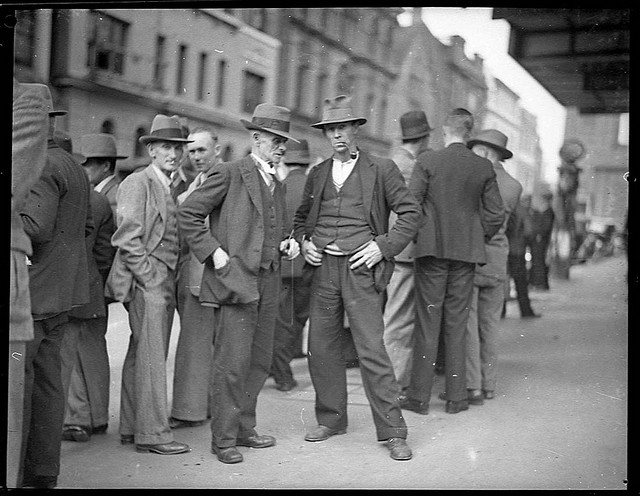

The man who invented the world wide web, Tim Berners-Lee spoke at the launch of the CSIRO’s Digital Productivity and Services Flagship in Sydney yesterday.

In telling about how the idea the idea of web, or Hyper Text Markup Language (HTML), came about Berners-Lee touched on some fundamental truths about innovation in big organisations.

In the 1990s the European Laboratory for Particle Physics (CERN) in Geneva had thousands of researchers bringing their own computers, it was an early version of what we now call the Bring Your Own Device (BYOD) policy.

“When they used their computers, they used their favourite computer running their favourite operating system. If they didn’t like what was available they wrote the software themselves,” said Tim. “Of course, none of these talked to each other.”

As a result sharing data was a nightmare as each scientist created documents using their own programs which often didn’t work on their colleagues’ computers.

Tim had the idea of standard language that would allow researchers to share information easily, although getting projects like this running in large bureaucratic organisations like CERN isn’t easy.

For getting HTML and the web running in CERN Tim gives credit to his boss, Mike Sendall, who supported him and his idea.

“If you’re wondering why innovation happens, one of the things is great bosses who let you do things on the side, Mike found an excuse to get a NeXT computer,” remembers Tim. “‘Why don’t you test it with your hypertext program?’ Mike said with a wink.”

There’s much talk about innovation in organisations, but without management support those ideas go nowhere, the story of the web is possibly the best example of what can happen when executives don’t just expect their workers to clock in, shut up and watch the clock.

One key point Tim made in his presentation was that it was twenty years after the Internet was invented before the web came along and another five years until the online world really took off.

We’re at that stage of development with the web now and with the development of the new HTML5 standard we’re going to see far more communication between machines.

Berners-Lee says “instead of having 1011 web pages communicating, we start to have 1011 computers talking to each other.”

These connections mean online innovation is only just beginning, we haven’t seen anything yet.

If you want your staff to stay quiet and watch the clock, that’s fine. But your clock might be figuring out how to do your job better than you can.

Tim Berners-Lee image courtesy of Tanaka on Flickr