Yesterday the National Australia Bank had a media briefing to show how they, like their competitors, are revamping their entire business around new technologies.

The investments are substantial and the re-organisation of the business is too as the old model of branch based banking only available from 9am to 4.30pm is superseded by the always on model of Internet banking delivered through tablets and smartphones.

One of the notable points the NAB executives made was their move to authenticating customers through voice recognition. A trial had found the system reduced fraud and social engineering attempts dramatically.

The use of voice recognition makes sense as it reduces the reliance on users remembering passwords or having to give over personal information that can often be gleaned off social media sites.

Again we’re seeing data security evolving away from passwords.

On the social media front, NAB are also offering their small business customers Facebook selling tools in collaboration with social media sales platform Tiger Pistol.

While it’s questionable that businesses will get that much from a Facebook store, it’s a good attempt from the bank to add some value and encourage their commercial customers to move online.

The move online is essential as the bank noted that online sales through their merchant platforms are up 23% as opposed to an anaemic 2.5% in general sales.

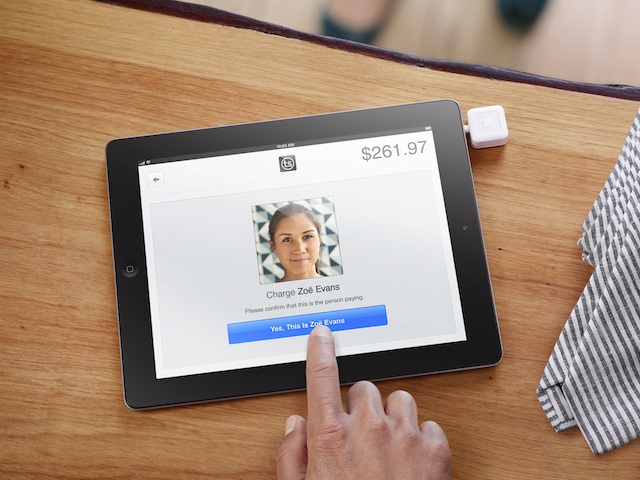

Along with passwords dying, the NAB also found that the cash register is dying and being replaced with smartphone and tablet apps. The bank itself is moving its online platforms to being ‘device agnostic’ so as not to be locked into any one technology.

What the NAB, and its competitor the Commonwealth Bank, are showing is the importance of having modern systems which are flexible enough to evolve with changes in the marketplace.

Smaller businesses could learn from the banks on just how important this investment is. The organisations who aren’t making these changes are steadily being left behind.