“We’re coming for our competitors” is the warning BlackBerry’s President of Global Enterprise Services, John Sims has for the marketplace in an interview last month.

Sims laid out how BlackBerry’s future lies in managing big data, providing collaboration tools and securing the internet of things. In the short term however, the company needs emerging markets to keep its mobile handset market going.

In an interview last month on Australia’s Gold Coast at the Gartner Symposium, Sims laid out some of BlackBerry’s vision of the company’s future.

Securing the endpoints

The key product is the BlackBerry Enterprise Services which Sims sees as providing the endpoint security for corporate mobile devices and for the internet of things, something that ties into the company’s QNX investment.

For the moment though its handsets are a key part of the company’s immediate future and Sims sees the latent demand from lapsed BlackBerry as essential to success, “there are tens of millions of BlackBerry users who are still sitting on their old handsets.”

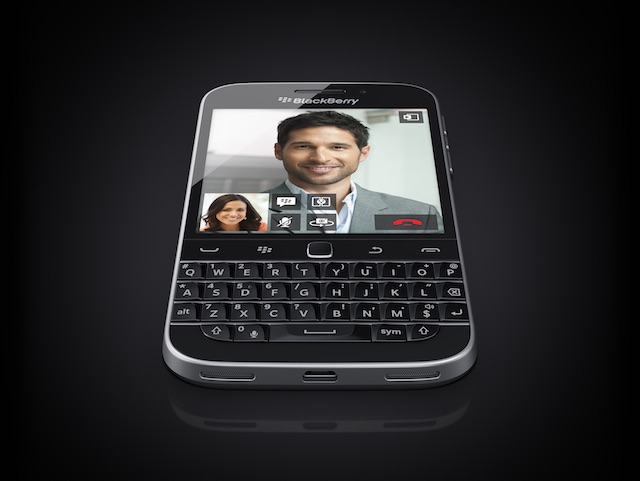

“The classic, when it comes along is targeted at that market. We know people are waiting.”

“When we went from the Gold to the Q10, too much changed. You had to go from the BBOS to the BlackBerry 10 and that’s a big change, we changed the keyboard, we took away shortcuts and we changed too much at the same time. With the Classic we’re almost doing a retrofit.”

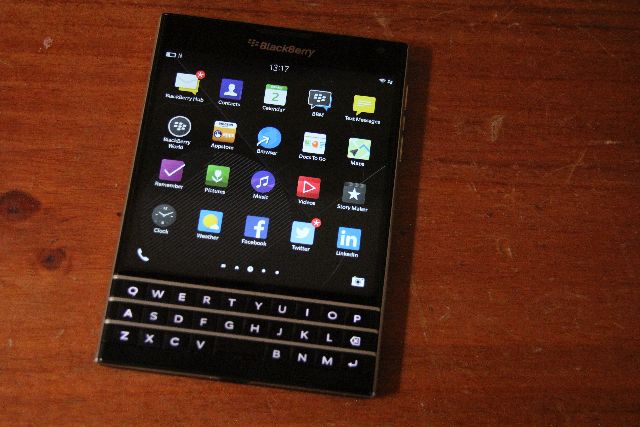

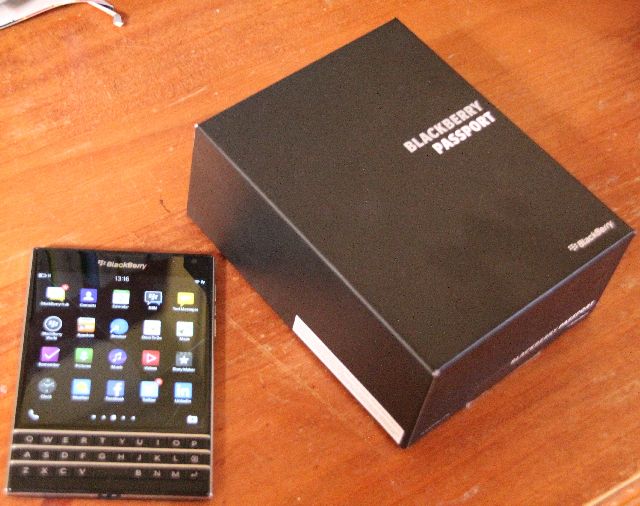

With the recently released Passport smartphone, Sims says the company is struggling to keep up with demand, “The Passport has done well,” he said. “The problem with it is us, not demand. It’s a supply issue not a demand issue.”

A week after that interview, BlackBerry announced the company would give Canadian buyers of the Passport subsidies of $600. How that ties into the narrative of a popular device isn’t quite clear.

Sims hopes the release of the Classic won’t suffer from supply problems, “we think is going to be more popular so we can be sure when it comes out we’ll be able to get that into the market in sufficient quantities to meet demand.

Discovering emerging markets

The other hope for BlackBerry’s handset business lies in developing markets, “Latin America is very important,” Sims says. “India’s very important and then there are number of important South East Asian markets.”

Part of that emerging market strategy is tied into selling mid priced smartphones into the market, Sims says. “People will say ‘the Z3 is a low end device’, if you go visit Indonesia the Z3 is not a low end device. It’s a middle market device.”

“Xiaomi is doing the low end devices at less than a hundred bucks and we’re doing a device at around $170. So we’re focused on the middle market, people who are professionals or aspiring professionals.”

“With those people in those markets we want to establish the BlackBerry brand as something they are comfortable with,” says Sims in outlining how he sees getting the handsets into business people as being the driver for the company’s other services and products.

Struggling with China

China remains an enigma for BlackBerry however, “in the last couple of years we haven’t focused on China, it’s a huge market and it’s hard for external parties to be successful on their own. Local partnerships are important.”

“John Chen (BlackBerry’s CEO) was recently in China and met with some of the local partners to talk about the possibilities of the future. It’s very preliminary and there’s nothing of any substance there yet but it is on our horizon that we’ve got to have something in the China Market.”

We’re coming for you

Despite the struggles BlackBerry has with its handset business, Sims is defiant about the company’s position in the endpoint security market.

“Ultimately it becomes a question of scale, we’ve got scale because we have a global network. None of the other EMM vendors – Good, Mobile Iron or Airwatch – none of them have the Big Data requirements that we have.”

“A year ago BlackBerry was defensive. We’re not defensive any more. People like Airwatch, Mobile Iron or Good should thank us that we were asleep at the wheel a few years ago and that allowed them to build their companies. That party’s over.”

“We’re coming after them. We have targets painted on each of those companies and as we execute our enterprise strategy we’re coming after them. If I was them I’d be feeling the breathing on the back of the neck.”

For BlackBerry the future lies in security services and the internet of things, though for the short term the company’s cash flow and market position depends upon sales of its handsets.

As the interview with John Sims shows, the company’s success depends upon a few key assumptions coming true; that’s a high risk market.

Paul travelled to the 2014 Australian Gartner Symposium on the Gold Coast as a guest of BlackBerry.

Similar posts: