The most important economic relationship in today’s economy is that between China and the United States, despite bellicose chest thumping by both sides their wealth and well being of their industries is inextricably linked.

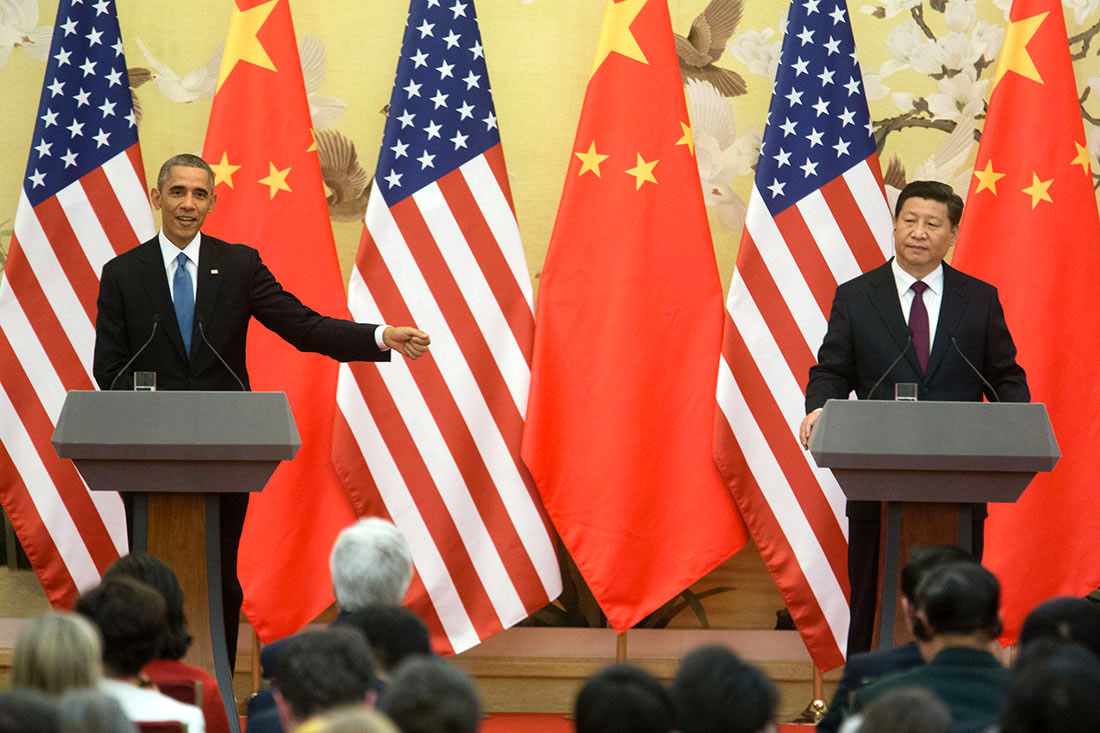

Against the backdrop of that chest thumping and a slowing Chinese economy, the Chinese and US Presidents are due to meet in two weeks time where trade and security relations between the two countries are at the top of the agenda.

China’s leaders though plan to emphasise their nation’s tech prowess and its importance to the US’s sector, something the New York Times reports has irritated the Obama administration.

What would almost further irritate the US leadership is that US tech giants including Apple, Facebook, IBM, Google and Uber have been invited to attend a Chinese tech summit hosted by Microsoft and the PRC President will be dining with Bill Gates before flying to Washington to meet Obama.

Redmond gets on board

Microsoft’s role in the China Forum is interesting, the company is extending the hand of friendship not just to nations but also to companies that were fierce rivals in the past, just last week the company announced a partnership with VMWare despite deep rivalry in recent years and CEO Satya Nadella is due to appear at next week’s Salesforce conference.

Coupled with Microsoft’s battle to keep offshore customers’ email records out of the reach of US legal jurisdiction, it’s clear Microsoft are playing a long global game with their business plans so the support of China’s initiatives isn’t surprising.

Given China’s strength as an emerging tech powerhouse and its administration’s ambition to move the economy up the value chain, it’s also not a surprise that other US technology companies are reluctant to join the politicians’ games.

Choosing Seattle

The choice of Seattle is interesting as well, while the city is a major tech centre with companies like Amazon and Microsoft based there, it’s far more integrated with the Pacific Rim economies than San Francisco and Silicon Valley. Again this is a loud message to the US tech community.

For China, the success of showing off their technological strengths is an important in sending a message to its East Asian neighbours and the US that the nation is diversifying and shouldn’t be underestimated, a process that Chinese Premier Li described as “a painful and treacherous process” at a World Economic Forum event in Dalian today.

The meeting between Xi Jinping and Barack Obama in two weeks time, and the associated events in Seattle, could well prove to be the marker of where China moved into the next phase of its economic development and its relationship with the United States.

Similar posts: