One of the truisms of modern business is that no incumbent is safe, Microsoft, Nokia and Hauwei are good examples of just how businesses that five years ago dominated their industries are now struggling with changed marketplaces.

In the last two days there’s been a number of stories on how the smartphone and computer markets are changing.

According to the Wall Street Journal’s tech blog, PC manufacturers are hoping Microsoft’s changes to Windows 8 reinvigorates the computer market.

Those hopes are desperate and somewhat touching in the face of a structural shift in the marketplace. These big vendors can wait for the Big White Hope to arrive but really they have only themselves to blame for their constant mis-steps in the tablet and smartphone markets.

Now they are left behind as more nimble competitors like Apple, Samsung and the rising wave of Chinese manufacturers deliver the products consumers want.

All is not lost for Microsoft though as Chinese telecoms giant Hauwei launches a Windows Phone for the US markets which will be available through Walmart.

Hauwei’s launch in the United States is not good news though for another failing incumbent – Nokia.

Nokia’s relationship with Microsoft seems increasingly troubled and the Finnish company is struggling to retain leadership even in the emerging markets which until recently had been the only bright spot in the organisation’s global decline.

Yesterday in India, Nokia launched a $99 smartphone to shore up its failing market position on the subcontinent.

For the three months to March, Nokia had a 23 percent share of mobile phone sales in India, the world’s second-biggest cellular market by customers, Strategy Analytics estimates. Three years ago it controlled more than half the Indian market.

India isn’t the only market where Nokia is threatened – in February Hauwei launched their 4Afrika Windows Phone aimed at phone users in Egypt, Nigeria, Kenya, Ivory Coast, Angola, Morocco and South Africa.

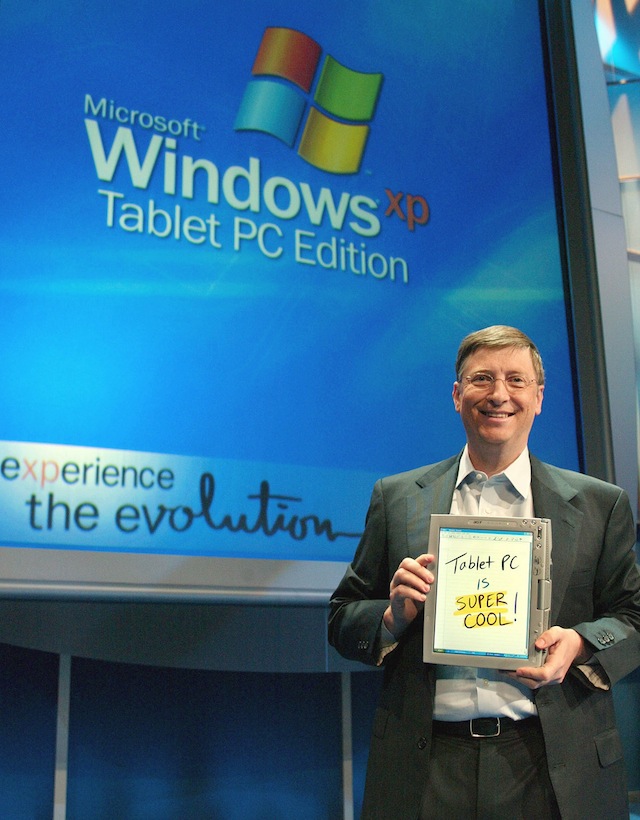

The smartphone market is instructive on how many industries are changing, almost overnight the iPhone changed the cell phone sector and three years later Apple repeated the trick with the iPad, in both cases incumbents like Motorola, Nokia and Microsoft found themselves flat footed.

As barriers are falling with cheaper manufacturing, faster prototyping and more accessible design tools, many other industries are facing the same disruption.

The question for every incumbent should be where the next disruption is coming from.

In fact, we all need to ask that question as those disruptions are changing our own jobs and communities.