It’s been a tough week for Apple, after the spectacular launch of the iPhone 6 the company has had two humiliating and worrying setbacks that indicate standards may be slipping at the once untouchable giant.

The iPhone 6 Plus should have been a triumph, and for a while it was, but the news the phones bend and distort has tarnished the product.

Compounding the bendable phone problem are the claims users are being charged to replace their damaged handsets.

On its own this problem might have been manageable like the iPhone4’s antenna problems in 2010, however today’s news that the latest iOS8 has had to be withdrawn after user complaints indicates a sloppiness has crept into the company.

Both problems, or all three problems if it turns out the stories of Genius Bars charging to replace damaged phones, show Apple isn’t paying attention to detail to the degree they’ve become known for.

The botched iOS8.0.1 rollout is sloppy work while the bendable phone is very much an uncharacteristic lapse in design.

For a premium brand with a large dose of arrogance, shipping defective products is both an embarrassment and damages the company’s name.

This inattention to detail is horribly reminiscent of Microsoft’s horror days at the turn of the Century where the company repeatedly rushed incomplete products to market — Windows ME being the most notorious example.

So maybe we are seeing Apple become the new Microsoft and the iPhone 6 Plus as the Windows ME of our time.

That doesn’t mean we’ll see the end of Apple, Microsoft is still a huge corporation, but it may be the tech industry’s most iconic business is beginning to lose its edge.

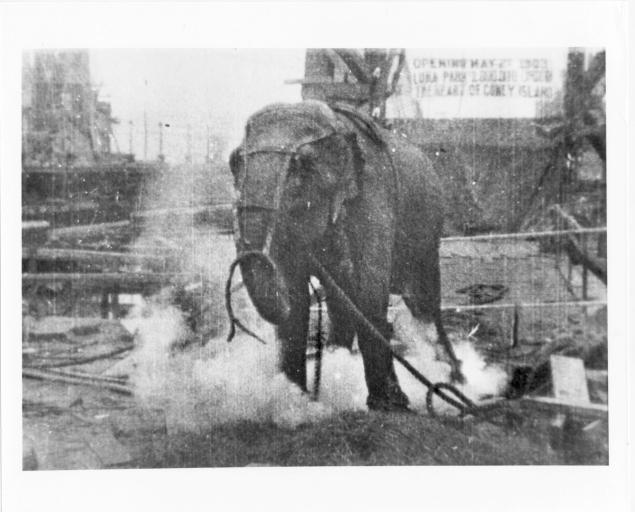

Image of Steve Jobs and Bill Gates via Wikipedia