One of the web’s promises was to eliminate the middleman – the retailer, the broker and the agent. During the heady days of the original dot com boom in the late 1990s many of us, including this writer, thought relationships between producers and consumers would become stronger without intermediaries.

As it turned out, things things didn’t quite work out that way with new middlemen like Uber and Amazon rising while some sectors, like real estate, just saw the industry evolve around new tools, distribution channels and advertising models.

Now it appears AirBnB is coming for the real estate industry with a plan to move into rental management, something that publicly bemuses the incumbents but no doubt privately worries them.

Like Uber, AirBnB is having to look at alternative revenue streams to justify its sky-high stock valuation. Particularly so given the company is looking at an IPO in the next few years.

Rental management is a pretty low margin, high maintenance business so it’s an odd choice for AirBnB and it’s not hard to think the real target is the real estate sales business which far more profitable and in many cases quite doable with algorithms.

No doubt real estate agents will retort with how they add value and how computers couldn’t do their sales job but in truth it’s like many other industries where automation can deliver cheaper and quicker results.

If AirBnB does successfully enter the real estate market the first victim won’t be the agents but the newspaper industry.

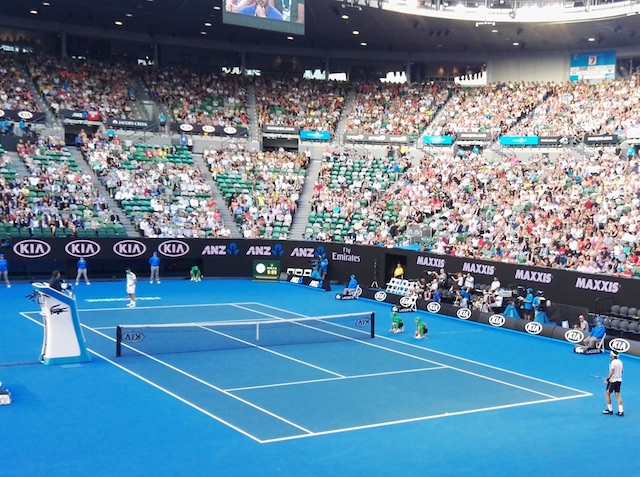

With local newspapers still dependent upon real estate display advertisements, particularly in Australia where the print media’s only real revenues come from property advertising, losing out to an app would be the industry’s killer blow.

As with many other things in the digital economy, it may be we underestimated how long it would take some industries to fall. We could be about to see two sectors fall to disruption now.