As usual, Apple’s World Wide Developer Conference in San Francisco yesterday concentrated the attention of the tech world.

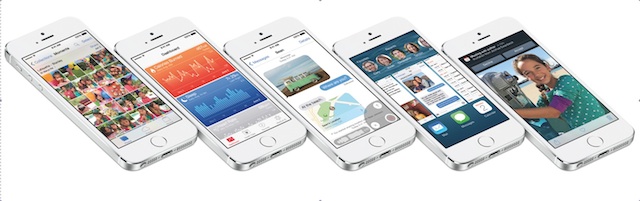

This year’s was a little more subdued than usual with the key announcement being around Apple’s new Yosemite OSX operating system, iOS8 and the new developer Software Developer Kit (SDK).

While a little underwhelming after all the speculation about smartwatches and fitness devices, these announcements mark a clear strategy for Apple to lock customers into their products through the cloud, smarthomes and wearable devices.

Open, but closed

Normally discussion about an SDK makes most people’s eyes glaze over, but Apple’s announcement marks a change in the company’s strategy in making over 4,000 APIs – Application Program Interfaces – open for developers to connect their programs into iOS8.

This marks a change for the company in allowing programs to easily hook into Apple’s mobile operating system and while it looks like a move to openness, the ease of making fitness applications, home automation and smart car services actually helps lock users into the Apple ecosystem.

Key to the ecosystem lock-in strategy are the Healthkit and Homekit services offering connections to health and home automation applications which are part of Apple’s Internet of things play, by offering easy access into the iPhone and iPad the company hopes to lock users of third party devices into the iOS world.

Increasing vendor lock-in

Similarly, the cloud services included with Yosemite and iOS8 increase that lock-in making it harder for users to step outside that ecosystem. It’s notable there’s no Android app version of the cloud service which indicates how Google is now Apple’s number one enemy.

Apple’s announcement today shows how the company is positioning itself to lock users into their services as the internet of things rolls into businesses, cars and homes.

It’s an indication the internet of things may well become a world of closed silos and it will be interesting to see how competitors react to Apple’s attempts to be the biggest walled garden.

Similar posts: