During the recession much was made about the ‘lipstick effect’ – the idea some businesses and products would survive because they’re little luxuries that cash strapped consumers will spend on while scrimping and saving in other areas.

Some of those areas are ladies’ cosmetics (lipstick), chocolate, movies and coffee shops. All of them offering small pleasures for a few dollars.

It’s a theory I’ve always been sceptical of and an episode of the BBC’s World Of Business where Peter Day travels to Cork to see how Ireland’s second city is recovering from the great recession illustrates the reality is a lot more complex than the theory suggests.

“We really struggled to keep alive,” Claire Nash of Nash 19 restaurant says in her interview with Day on her business experience during the recession.

“My turnover just absolutely took a spiralling tumble and it wasn’t that the customer weren’t coming in – those that had lost their jobs weren’t coming in – but those that hadn’t lost their jobs were really hurting and they were very careful with their spend.

“So they started using us as a treat, which was a model I never wanted to enter into but we weathered the storm.”

It can be argued that Claire survived because of the lipstick effect – she kept enough customers to survive – but it was tough and had she taken out the loans offered to her during the boom it’s unlikely her restaurant would have survived.

The key point though is the lipstick effect turned out to be a very different, and much less lucrative business, for Claire and other businesses in Cork.

So assuming a business will remained unscathed because of the assumption the lipstick effect is a big risk, if that’s the plan then Sequoia Capital’s infamous Powerpoint of Doom comes to mind.

While the presentation was aimed at tech companies and investors, it’s a good overview of how the Global Financial Crisis happened and Slide 49 – Survival of the Quickest – is probably the best lesson for any business: Act fast to adapt.

The lipstick theory is a nice way to justify unsustainable business models, particularly those that rely on consumer spending, in the face of a recession but the assumption spending will remain the same as customers will seek little luxuries is deeply flawed.

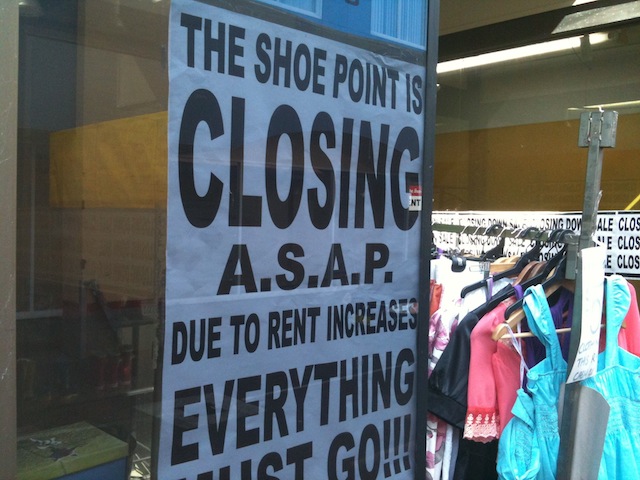

A business that doesn’t respond quickly to changed circumstances and reduced spending is one that might not survive a downturn.

Peter Day’s Cork story is a good listen on how Ireland and Cork have weathered the global financial crisis, the main question from the piece is how much have the Irish and the rest of the world learned from the mistakes of the boom years at the start of the 21st Century.