One of the predictions for 2020 is that decade’s business successes will be those who use big data well.

A good example of a big data tool is recruitment software Evolv that helps businesses predict not only the best person to hire but also who is likely to leave the organisation.

For employee retention, Evolv looks at a range of variables which can include anything from gas prices and social media usage to local unemployment rates then pulls these together to predict which staff are most likely to leave.

“It’s hard to understand why it’s radically predictive, but it’s radically predictive,” Venture Beat quotes Jim Meyerle, Evolv’s cofounder.

There are some downsides in such software though – as some of the comments to the VentureBeat story point out – a blind faith in an alogrithm can destroy company morale and much more.

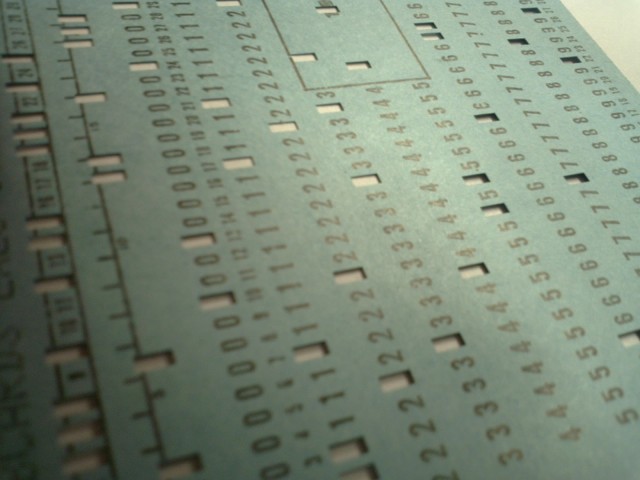

Recruiters as an industry haven’t a good track record in using data well, while they’ve had candidate databases for two decades and stories abound of poor use of keyword searches carried out by lazy or incompetent headhunters. The same is now happening with agencies trawling LinkedIn for candidates.

Using these tools and data correctly going to separate successful recruitment agencies and HR departments from the also-rans.

It’s the same in most businesses – the tools are available and knowing them how to use them properly will be a key skill for this decade.

Job classifieds image courtesy of Markinpool through SXC.HU