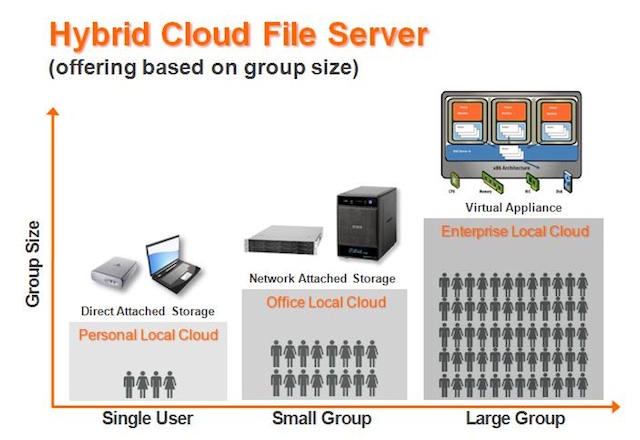

One of the biggest changes in business is the move to subscription based services rather than selling one-off, lump sum products. This is affecting industries ranging from the motor industry to software.

Business Spectator has a good interview with Tien Zhou of Zuora on the subscription economy and how it’s changing the business world.

We’re pretty passionate in our belief that every company will be a subscription business in the next five, 10, 20 years. That’s certainly what we’re seeing with digital companies, whether they are technology firms (software, hardware), media and publishing firms, or telecom companies. The ideas of content and access are starting to blend together and we are seeing more and more commerce companies dip their feet as well. So we’re really see this as an across the board phenomenon.

Probably the industry most focused on the subscription model right now are newspapers – subscribers have always been an important revenue stream for the print media and the loss of their advertising rivers of gold means they are looking at ways to get more money from readers.

As Tien Zhou points out, businesses moving to subscription services is an across the board phenomenon.

Yesterday I mentioned the Google Maps connected treadmill, that is a subscription model where the treadmill seller gets money from the initial purchase, but also a revenue stream from the services attached to it.

The same business model applies to connected motor cars or the social media enabled jet engine. The aim is to replace lump sum purchases with lifetime subscriptions.

Getting customers onto lifetime subscriptions has been one of Microsoft’s aims for the past decade as the company realised that software users, particularly those using Microsoft Office, hung onto their CDs for years and increasingly decades.

Perversely it took Google and Apple to show Microsoft how to wean customers onto subscription services.

That Microsoft Office is a good example of the evolution of subscription software, or Software-as-a-Service (SaaS), isn’t an accident. The enterprise computing sector is currently the most profoundly affected as companies like Google and Salesforce threaten high cost incumbents.

A good example of the changing economics of software is the supermarket chain Woolworths moving onto Google Docs.

With 26,000 seats, the reseller can expect to make $260,000 a year in commissions based on Google’s standard terms of $10 per seat per year.

That total sum is less than the commission a salesperson would have earned for a similar sized IBM, Oracle or Microsoft installation.

A whole generation of IT salespeople who’ve grown fat and comfortable on their generous commissions now find their incomes being dramatically reduced.

Similar things are happening in industries like call centres with Zendesk, point of sale systems and event ticketing with Eventbrite – incumbents are finding their incomes steadily being eroded away by online services.

At the same time agricultural and mining equipment suppliers are introducing big data services for their customers where the information gathered by the sensors built into modern tractors and bulldozers are providing valuable intelligence about the crop and ore being gathered.

The subscription business model is nothing new, King Camp Gillette perfected the strategy with the safety razor at the beginning of the Twentieth Century. The razors were cheap but the blades were where the money was.

Microsoft and the rest of the software industry tried to introduce subscriptions in the late 1990s with Software as a Service, but failed because the internet wasn’t mature enough to support the model. Today it is.

Like many things in today’s economy, the subscription model is going to change a lot of markets. It’s a great opportunity for disruptive businesses.

Subscription envelope image courtesy of jaylopez through sxc.hu