This morning Microsoft announced its quarterly results and, once again, they confirmed the company’s move into the cloud, a transition that means the company has to deal with reduced margins in once immensely profitable markets.

While Microsoft’s earnings beat analyst estimates, the stock still dropped on out of hours trading on the US markets. The reason being margins showed a slight decline and the impending release of Windows 10, which will be free for customers upgrading, portends a further fall in income.

The fading of Windows is best shown in the results for the company’s Devices and Consumer licensing division which covers licensing of the operating system and is the second biggest contributor to Microsoft’s revenues and profits. The segment’s takings are slowly declining although surprisingly the division’s margins are standing up.

Windows’ decline shows the post XP recovery Microsoft was hoping for the division has failed to materialise beyond a bump last quarter, as the company explained in its media release;

Windows OEM Pro revenue declined 13%; revenue was impacted by the business PC market and Pro mix returning to pre-Windows XP end of support levels and by new lower-priced licenses for devices sold to academic customers

With company making various versions of Windows 8 and 10 free, it’s hard to see the division doing anything but accelerating its decline as fewer people actually pay for the operating system.

Fading margins

Also illustrating Windows’ falling fortunes is how the Computer and Gaming Hardware division’s revenue threatens to overtake the Devices and Consumer Licensing group’s contribution. The problem for Microsoft with this that the manufacture of Xboxes and Surface tablets only boasts a profit margin of 12% against consumer licensing’s 93%.

Last week at its preview of Windows 10 Microsoft showcased its HoloLens virtual reality technology, while impressive it’s unlikely to boast margins any better than Xbox consoles or Surface tablets. At best it will be a trivial contribution to the company’s bottom line.

Microsoft Margins by operating segment

| Percentage margins | Q1-14 | Q2-14 | Q3-14 | Q4-14 | Q1-15 | Q2-15 |

| Devices and Consumer Licensing | 87% | 90% | 87% | 92% | 93% | 93% |

| Computing and Gaming Hardware | 15% | 9% | 14% | 1% | 20% | 12% |

| Phone Hardware | n/a | n/a | n/a | 3% | 18% | 14% |

| Devices and Consumer Other | 21% | 21% | 21% | 17% | 17% | 23% |

| Commercial Licensing | 92% | 92% | 91% | 92% | 92% | 93% |

| Commercial Other | 17% | 23% | 25% | 31% | 33% | 35% |

Dwarfing both divisions in both revenue and profit is the Commercial Licensing segment which also boasts fat margins of 93% and accounts for nearly half the money coming into the organisation. Commercial Licensing remains static and provides the bedrock for the company’s cashflow.

The big growth area remains the cloud with the Other Commercial division, which includes most of the online and professional services growing steadily. While showing growth, this part of the business boasts a relatively low margin of 33% so any market moves from Enterprise licensing to the cloud will have a sharp effect on the company’s bottom line.

Mobile black holes

Of all Microsoft’s divisions, the problem remains the Phone Hardware segment with low margins, declining sales and a shrinking market share. Reports released overnight indicate that over a third of Lumia devices sold are not being activated which may indicate distribution channels are having to deal with unsold stock.

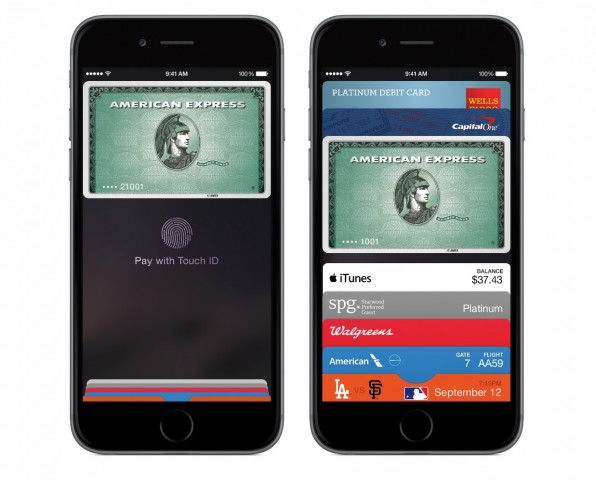

Compounding Microsoft’s poor position in the phone marketplace is the resurgence of Apple’s iPhone, particularly in the Chinese market where Microsoft is failing dismally. Global market share figures are indicating Apple may soon overtake Samsung as the world’s largest smartphone vendor while Android systems are coming to dominate the global marketplace.

Tomorrow Apple will announce their results and we’ll see how the two companies are travelling, the contrasts will almost certainly be striking. For Microsoft, even if they do manage a shift to mobility and the cloud, they are unlikely to repeat Apple’s success in reinventing themselves.