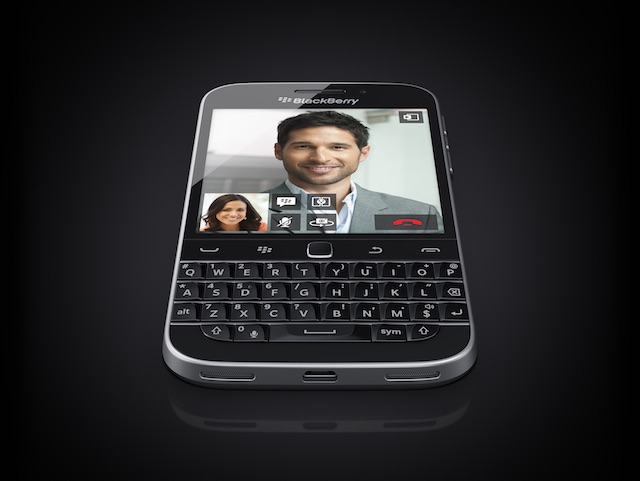

Earlier this week BlackBerry released its Classic handset – the device the company hopes will rekindle its fortunes in the smartphone market in appealing to the thousands of loyal corporate users still wedded to their old devices.

For BlackBerry the stakes are high with the handset business still being worth over half the company’s earnings last financial year, although hardware revenue dropped 43% to $3.8 billion over that period.

“Handsets are still an important part of our business in terms of revenues,” BlackBerry’s President of Global Enterprise Services, John Sims told Decoding the New Economy in an interview last month.

The main market for the Classic are the corporate users still sitting on their old handsets, “there are tens of millions of BlackBerry users who are still sitting on their old handsets.” Sims said. “The classic, when it comes along is targeted at that market. We know people are waiting.”

“When you get on a plane people start taking out their devices I can guarantee you’ll see BlackBerry Bolds with almost every person in business and first class. They may have another device too – a Samsung or something as well.”

Sims’ belief was that bringing back the shortcuts and keyboard of the older devices would encourage users wedded to their old devices to buy the new smartphone.

The first response to the new BlackBerry Classic hasn’t been enthusiastic with Larry Dignan in the Canadian Globe and Mail describing it as “a curmudgeonly phone” – a worrying description coming from the home team. Dignan goes further in questioning BlackBerry’s hope the Classic will attract the users it needs.

BlackBerry remains convinced that its hardcore enterprise users are crying out for the unique set of features only it can offer. But after using it for several days I don’t think the Classic is old fashioned enough to please traditionalists, and its callbacks to a dead era of smartphone mobility are more than enough to cripple the device for new users.

For BlackBerry, the success or otherwise of its handsets is going to be critical in the company’s transition to a security, software and internet of things business. The early indications are that the company has a struggle ahead.